Julian Sester

18 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Robust $Q$-learning Algorithm for Markov Decision Processes under Wasserstein Uncertainty

We present a novel $Q$-learning algorithm tailored to solve distributionally robust Markov decision problems where the corresponding ambiguity set of transition probabilities for the underlying Markov...

Non-concave distributionally robust stochastic control in a discrete time finite horizon setting

In this article we present a general framework for non-concave distributionally robust stochastic control problems in a discrete time finite horizon setting. Our framework allows to consider a varie...

Measuring Name Concentrations through Deep Learning

We propose a new deep learning approach for the quantification of name concentration risk in loan portfolios. Our approach is tailored for small portfolios and allows for both an actuarial as well a...

On the Relevance and Appropriateness of Name Concentration Risk Adjustments for Portfolios of Multilateral Development Banks

Sovereign loan portfolios of Multilateral Development Banks (MDBs) typically consist of only a small number of borrowers and hence are heavily exposed to single name concentration risk. Based on rea...

Bounding the Difference between the Values of Robust and Non-Robust Markov Decision Problems

In this note we provide an upper bound for the difference between the value function of a distributionally robust Markov decision problem and the value function of a non-robust Markov decision probl...

On intermediate Marginals in Martingale Optimal Transportation

We study the influence of additional intermediate marginal distributions on the value of the martingale optimal transport problem. From a financial point of view, this corresponds to taking into acc...

Neural networks can detect model-free static arbitrage strategies

In this paper we demonstrate both theoretically as well as numerically that neural networks can detect model-free static arbitrage opportunities whenever the market admits some. Due to the use of ne...

A Multi-Marginal C-Convex Duality Theorem for Martingale Optimal Transport

A convex duality result for martingale optimal transport problems with two marginals was established in Beiglb\"ock et al. (2013). In this paper we provide a generalization of this result to the mul...

Markov Decision Processes under Model Uncertainty

We introduce a general framework for Markov decision problems under model uncertainty in a discrete-time infinite horizon setting. By providing a dynamic programming principle we obtain a local-to-g...

Improved Robust Price Bounds for Multi-Asset Derivatives under Market-Implied Dependence Information

We show how inter-asset dependence information derived from market prices of options can lead to improved model-free price bounds for multi-asset derivatives. Depending on the type of the traded opt...

Detecting data-driven robust statistical arbitrage strategies with deep neural networks

We present an approach, based on deep neural networks, that allows identifying robust statistical arbitrage strategies in financial markets. Robust statistical arbitrage strategies refer to trading ...

Robust deep hedging

We study pricing and hedging under parameter uncertainty for a class of Markov processes which we call generalized affine processes and which includes the Black-Scholes model as well as the constant...

A deep learning approach to data-driven model-free pricing and to martingale optimal transport

We introduce a novel and highly tractable supervised learning approach based on neural networks that can be applied for the computation of model-free price bounds of, potentially high-dimensional, f...

Robust Q-Learning for finite ambiguity sets

In this paper we propose a novel $Q$-learning algorithm allowing to solve distributionally robust Markov decision problems for which the ambiguity set of probability measures can be chosen arbitrarily...

Generative model for financial time series trained with MMD using a signature kernel

Generating synthetic financial time series data that accurately reflects real-world market dynamics holds tremendous potential for various applications, including portfolio optimization, risk manageme...

Distributionally Robust Deep Q-Learning

We propose a novel distributionally robust $Q$-learning algorithm for the non-tabular case accounting for continuous state spaces where the state transition of the underlying Markov decision process i...

Empirical Analysis of the Model-Free Valuation Approach: Hedging Gaps, Conservatism, and Trading Opportunities

In this paper we study the quality of model-free valuation approaches for financial derivatives by systematically evaluating the difference between model-free super-hedging strategies and the realized...

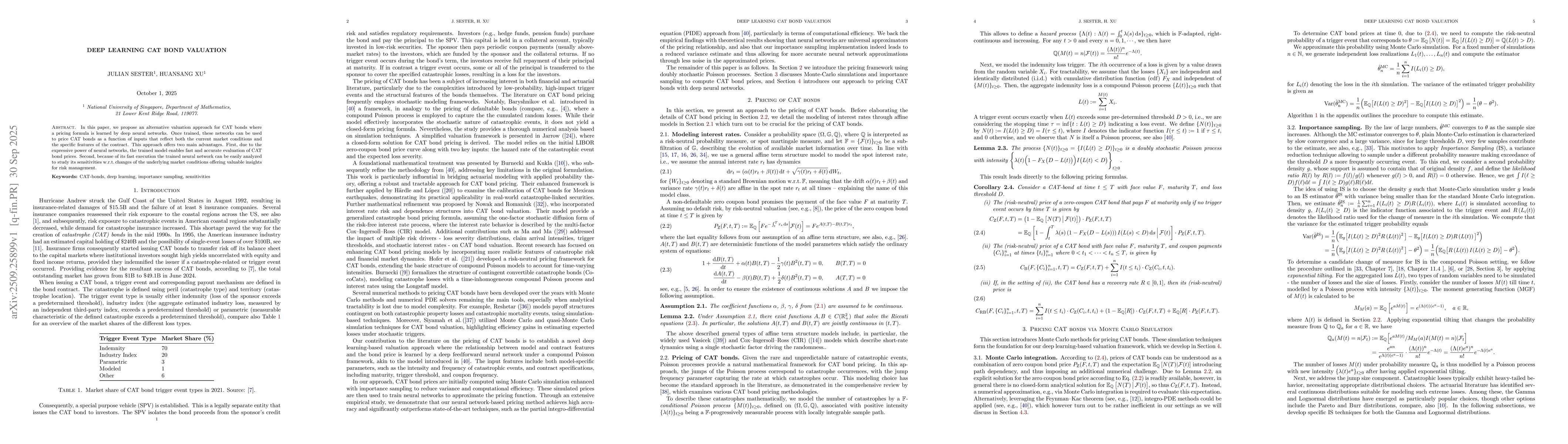

Deep learning CAT bond valuation

In this paper, we propose an alternative valuation approach for CAT bonds where a pricing formula is learned by deep neural networks. Once trained, these networks can be used to price CAT bonds as a f...