Authors

Summary

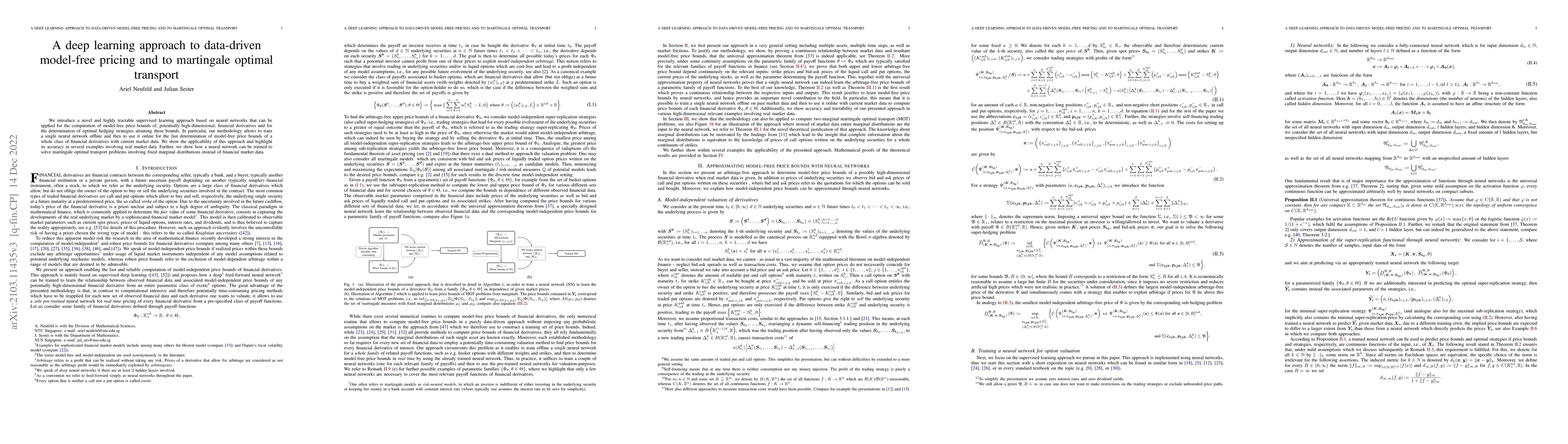

We introduce a novel and highly tractable supervised learning approach based on neural networks that can be applied for the computation of model-free price bounds of, potentially high-dimensional, financial derivatives and for the determination of optimal hedging strategies attaining these bounds. In particular, our methodology allows to train a single neural network offline and then to use it online for the fast determination of model-free price bounds of a whole class of financial derivatives with current market data. We show the applicability of this approach and highlight its accuracy in several examples involving real market data. Further, we show how a neural network can be trained to solve martingale optimal transport problems involving fixed marginal distributions instead of financial market data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFrom entropic transport to martingale transport, and applications to model calibration

Jean-David Benamou, Guillaume Chazareix, Grégoire Loeper

| Title | Authors | Year | Actions |

|---|

Comments (0)