Summary

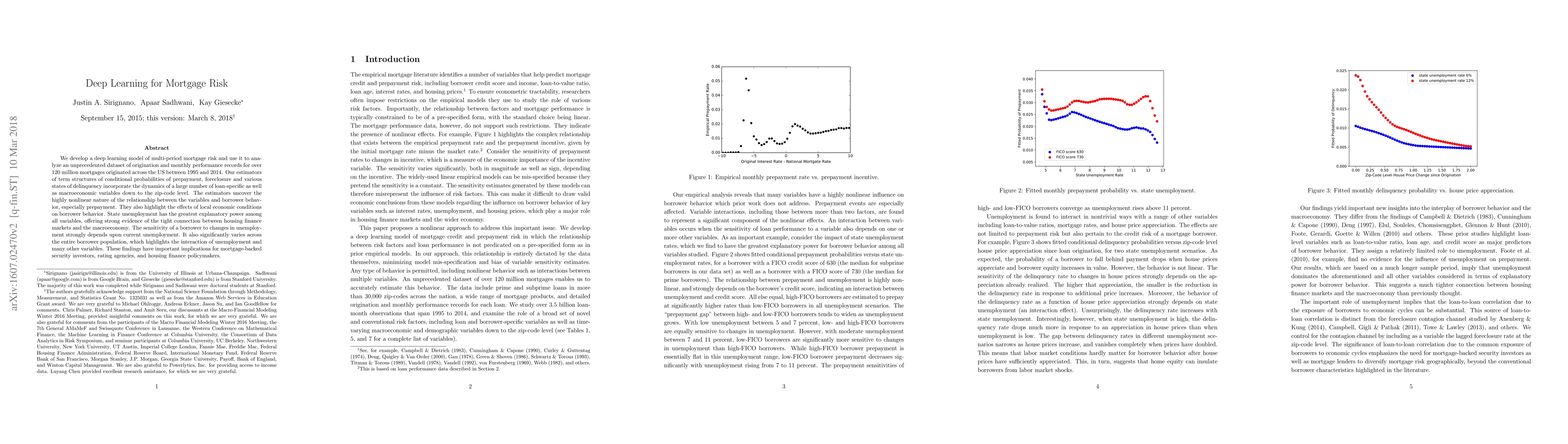

We develop a deep learning model of multi-period mortgage risk and use it to analyze an unprecedented dataset of origination and monthly performance records for over 120 million mortgages originated across the US between 1995 and 2014. Our estimators of term structures of conditional probabilities of prepayment, foreclosure and various states of delinquency incorporate the dynamics of a large number of loan-specific as well as macroeconomic variables down to the zip-code level. The estimators uncover the highly nonlinear nature of the relationship between the variables and borrower behavior, especially prepayment. They also highlight the effects of local economic conditions on borrower behavior. State unemployment has the greatest explanatory power among all variables, offering strong evidence of the tight connection between housing finance markets and the macroeconomy. The sensitivity of a borrower to changes in unemployment strongly depends upon current unemployment. It also significantly varies across the entire borrower population, which highlights the interaction of unemployment and many other variables. These findings have important implications for mortgage-backed security investors, rating agencies, and housing finance policymakers.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Spatio-Temporal Machine Learning Model for Mortgage Credit Risk: Default Probabilities and Loan Portfolios

Fabio Sigrist, Pascal Kündig

Simulate and Optimise: A two-layer mortgage simulator for designing novel mortgage assistance products

Sumitra Ganesh, Leo Ardon, Deepeka Garg et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)