Summary

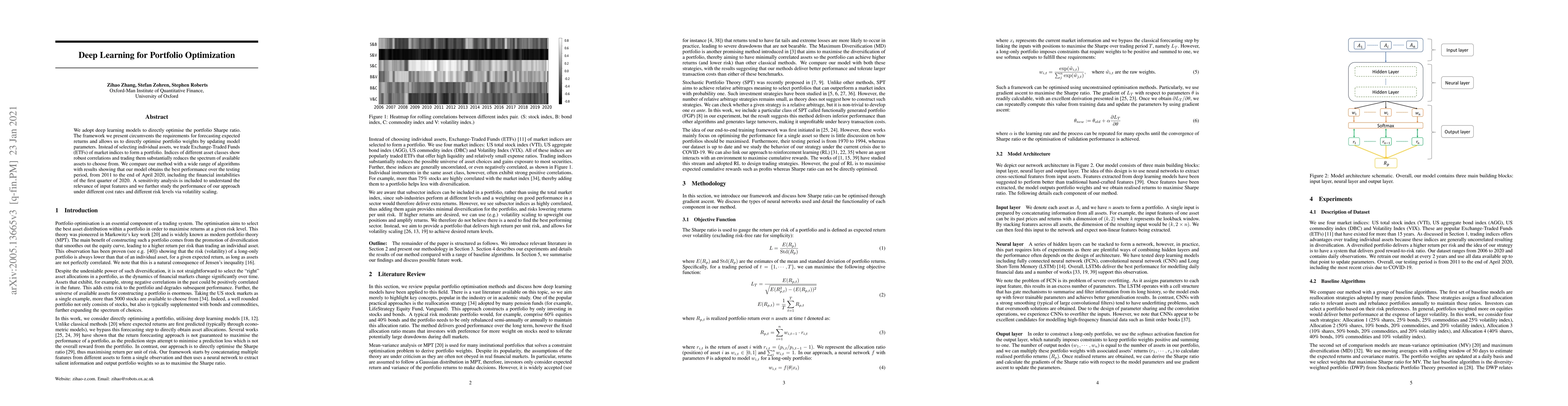

We adopt deep learning models to directly optimise the portfolio Sharpe ratio. The framework we present circumvents the requirements for forecasting expected returns and allows us to directly optimise portfolio weights by updating model parameters. Instead of selecting individual assets, we trade Exchange-Traded Funds (ETFs) of market indices to form a portfolio. Indices of different asset classes show robust correlations and trading them substantially reduces the spectrum of available assets to choose from. We compare our method with a wide range of algorithms with results showing that our model obtains the best performance over the testing period, from 2011 to the end of April 2020, including the financial instabilities of the first quarter of 2020. A sensitivity analysis is included to understand the relevance of input features and we further study the performance of our approach under different cost rates and different risk levels via volatility scaling.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMultimodal Deep Reinforcement Learning for Portfolio Optimization

James Zhang, Sumit Nawathe, Ravi Panguluri et al.

Deep Reinforcement Learning and Mean-Variance Strategies for Responsible Portfolio Optimization

Manuela Veloso, Fernando Acero, Parisa Zehtabi et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)