Summary

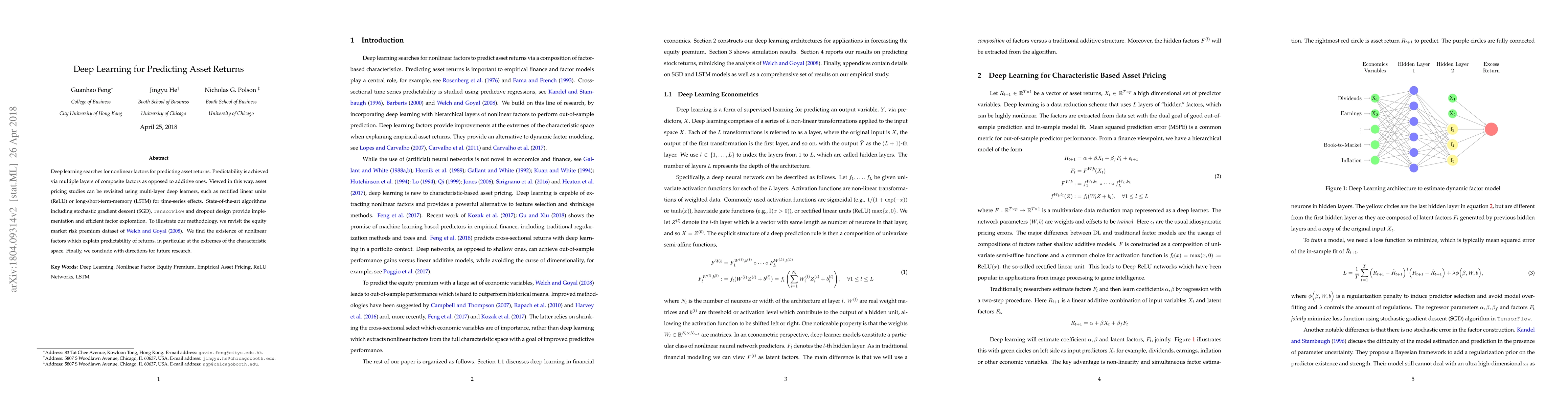

Deep learning searches for nonlinear factors for predicting asset returns. Predictability is achieved via multiple layers of composite factors as opposed to additive ones. Viewed in this way, asset pricing studies can be revisited using multi-layer deep learners, such as rectified linear units (ReLU) or long-short-term-memory (LSTM) for time-series effects. State-of-the-art algorithms including stochastic gradient descent (SGD), TensorFlow and dropout design provide imple- mentation and efficient factor exploration. To illustrate our methodology, we revisit the equity market risk premium dataset of Welch and Goyal (2008). We find the existence of nonlinear factors which explain predictability of returns, in particular at the extremes of the characteristic space. Finally, we conclude with directions for future research.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersGeneralized Distribution Prediction for Asset Returns

María Óskarsdóttir, Ísak Pétursson

| Title | Authors | Year | Actions |

|---|

Comments (0)