Summary

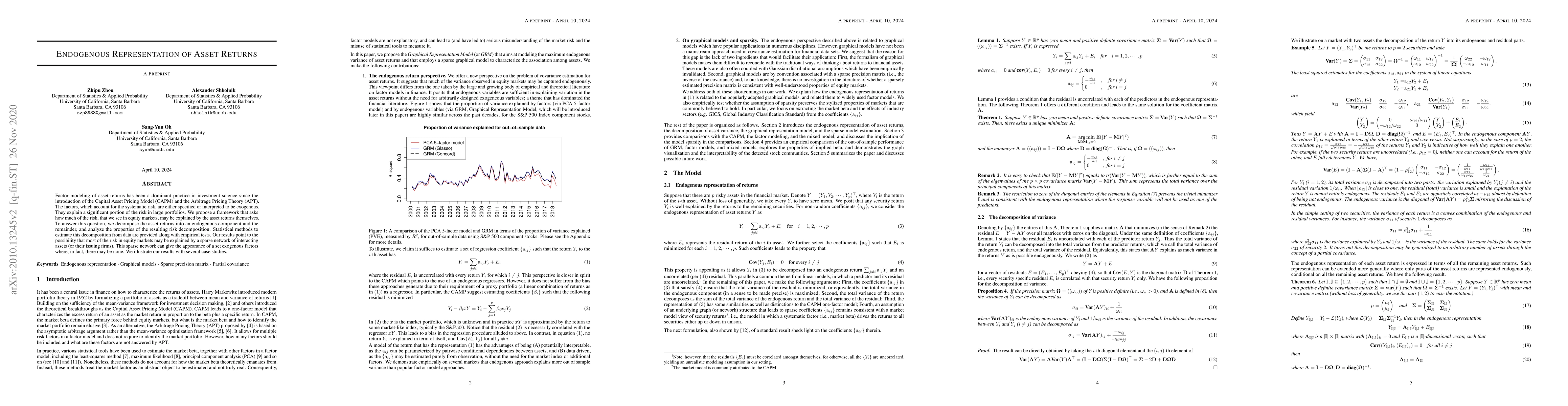

Factor modeling of asset returns has been a dominant practice in investment science since the introduction of the Capital Asset Pricing Model (CAPM) and the Arbitrage Pricing Theory (APT). The factors, which account for the systematic risk, are either specified or interpreted to be exogenous. They explain a significant portion of the risk in large portfolios. We propose a framework that asks how much of the risk, that we see in equity markets, may be explained by the asset returns themselves. To answer this question, we decompose the asset returns into an endogenous component and the remainder, and analyze the properties of the resulting risk decomposition. Statistical methods to estimate this decomposition from data are provided along with empirical tests. Our results point to the possibility that most of the risk in equity markets may be explained by a sparse network of interacting assets (or their issuing firms). This sparse network can give the appearance of a set exogenous factors where, in fact, there may be none. We illustrate our results with several case studies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersGeneralized Distribution Prediction for Asset Returns

María Óskarsdóttir, Ísak Pétursson

No citations found for this paper.

Comments (0)