Summary

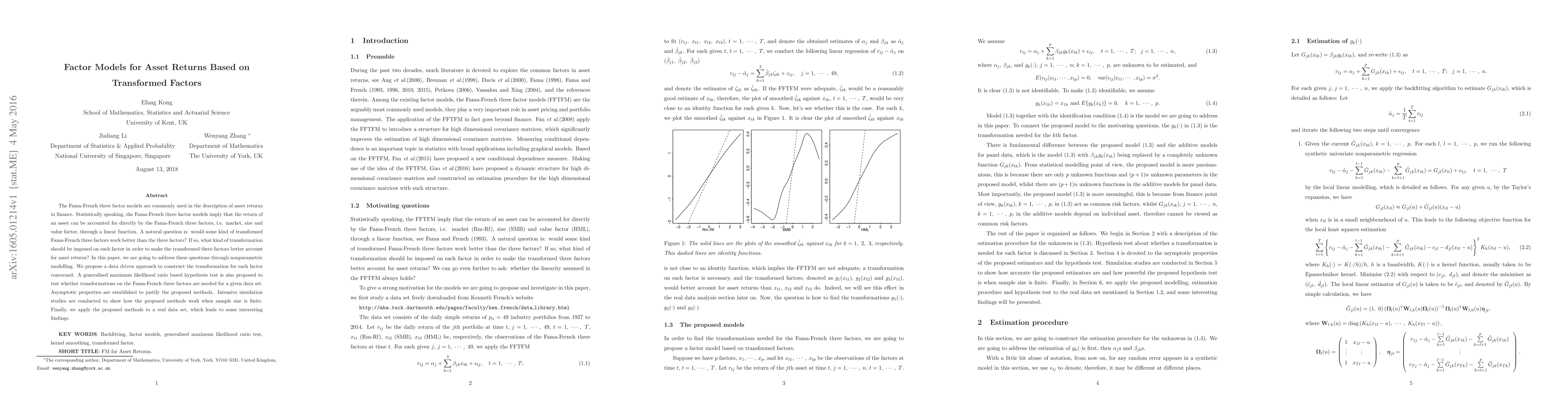

The Fama-French three factor models are commonly used in the description of asset returns in finance. Statistically speaking, the Fama-French three factor models imply that the return of an asset can be accounted for directly by the Fama-French three factors, i.e. market, size and value factor, through a linear function. A natural question is: would some kind of transformed Fama-French three factors work better than the three factors? If so, what kind of transformation should be imposed on each factor in order to make the transformed three factors better account for asset returns? In this paper, we are going to address these questions through nonparametric modelling. We propose a data driven approach to construct the transformation for each factor concerned. A generalised maximum likelihood ratio based hypothesis test is also proposed to test whether transformations on the Fama-French three factors are needed for a given data set. Asymptotic properties are established to justify the proposed methods. Intensive simulation studies are conducted to show how the proposed methods work when sample size is finite. Finally, we apply the proposed methods to a real data set, which leads to some interesting findings.

AI Key Findings

Generated Sep 02, 2025

Methodology

The paper proposes a data-driven approach to construct transformations for Fama-French three factors using nonparametric modelling and a generalized maximum likelihood ratio-based hypothesis test.

Key Results

- The paper introduces a method to transform Fama-French factors and tests if such transformations are needed for a given dataset.

- Intensive simulation studies show that the proposed methods work well even with finite sample sizes.

- Application to a real dataset yields interesting findings, indicating the necessity of transformations on the Fama-French three factors.

Significance

This research is significant as it enhances the Fama-French asset pricing model by considering transformed factors, potentially improving the explanation of asset returns.

Technical Contribution

The paper presents a novel nonparametric approach for transforming Fama-French factors and a hypothesis test to determine the necessity of such transformations.

Novelty

This work stands out by employing nonparametric modelling and a generalized maximum likelihood ratio test to determine optimal transformations for Fama-French factors, unlike previous research that primarily focused on linear transformations or other specific factor models.

Limitations

- The paper does not discuss the practical implications or implementation challenges of the proposed transformations in real-world portfolio management.

- Limited scope to other factor models beyond Fama-French three factors.

Future Work

- Explore the practical implications and implementation of the proposed transformations in portfolio management strategies.

- Investigate the performance of the transformed factors in other asset pricing models and across various market conditions.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersGeneralized Distribution Prediction for Asset Returns

María Óskarsdóttir, Ísak Pétursson

| Title | Authors | Year | Actions |

|---|

Comments (0)