Authors

Summary

This paper tackles the challenge of learning non-Markovian optimal execution strategies in dynamic financial markets. We introduce a novel actor-critic algorithm based on Deep Deterministic Policy Gradient (DDPG) to address this issue, with a focus on transient price impact modeled by a general decay kernel. Through numerical experiments with various decay kernels, we show that our algorithm successfully approximates the optimal execution strategy. Additionally, the proposed algorithm demonstrates adaptability to evolving market conditions, where parameters fluctuate over time. Our findings also show that modern reinforcement learning algorithms can provide a solution that reduces the need for frequent and inefficient human intervention in optimal execution tasks.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

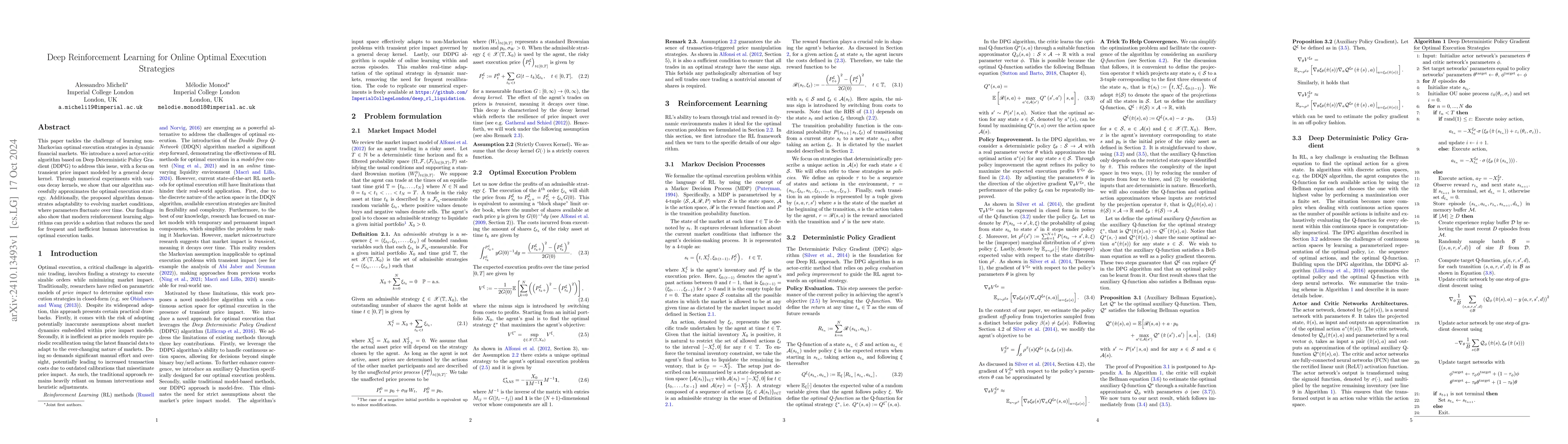

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Modular Framework for Reinforcement Learning Optimal Execution

Fernando de Meer Pardo, Christoph Auth, Florin Dascalu

No citations found for this paper.

Comments (0)