Authors

Summary

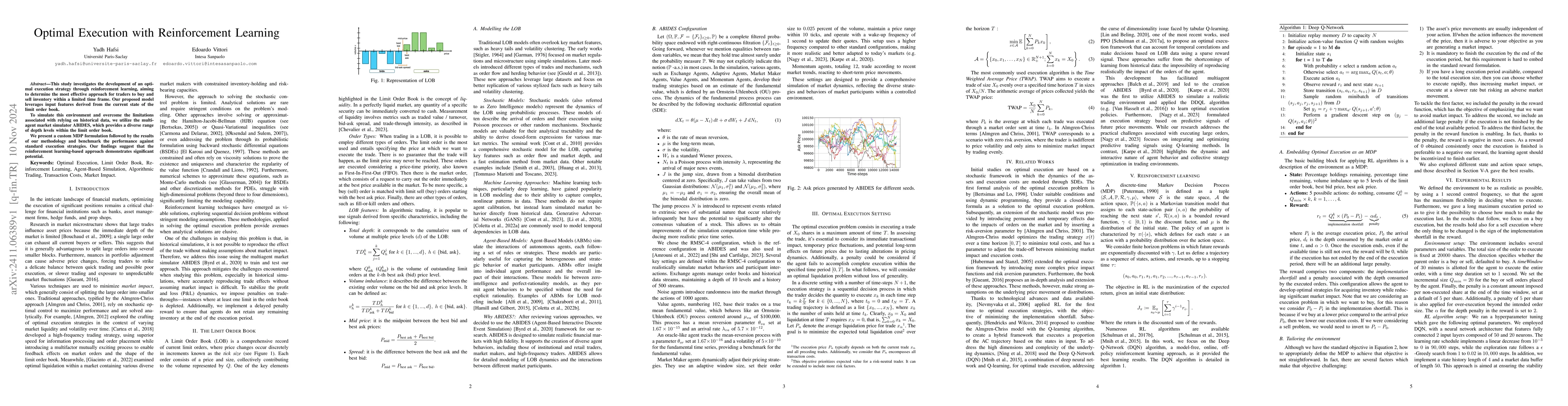

This study investigates the development of an optimal execution strategy through reinforcement learning, aiming to determine the most effective approach for traders to buy and sell inventory within a limited time frame. Our proposed model leverages input features derived from the current state of the limit order book. To simulate this environment and overcome the limitations associated with relying on historical data, we utilize the multi-agent market simulator ABIDES, which provides a diverse range of depth levels within the limit order book. We present a custom MDP formulation followed by the results of our methodology and benchmark the performance against standard execution strategies. Our findings suggest that the reinforcement learning-based approach demonstrates significant potential.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep Reinforcement Learning for Online Optimal Execution Strategies

Mélodie Monod, Alessandro Micheli

A Modular Framework for Reinforcement Learning Optimal Execution

Fernando de Meer Pardo, Christoph Auth, Florin Dascalu

Reinforcement Learning for Trade Execution with Market Impact

Patrick Cheridito, Moritz Weiss

No citations found for this paper.

Comments (0)