Edoardo Vittori

5 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

CVA Hedging by Risk-Averse Stochastic-Horizon Reinforcement Learning

This work studies the dynamic risk management of the risk-neutral value of the potential credit losses on a portfolio of derivatives. Sensitivities-based hedging of such liability is sub-optimal bec...

Reinforcement Learning for Credit Index Option Hedging

In this paper, we focus on finding the optimal hedging strategy of a credit index option using reinforcement learning. We take a practical approach, where the focus is on realism i.e. discrete time,...

Exploiting Risk-Aversion and Size-dependent fees in FX Trading with Fitted Natural Actor-Critic

In recent years, the popularity of artificial intelligence has surged due to its widespread application in various fields. The financial sector has harnessed its advantages for multiple purposes, incl...

Optimal Execution with Reinforcement Learning

This study investigates the development of an optimal execution strategy through reinforcement learning, aiming to determine the most effective approach for traders to buy and sell inventory within a ...

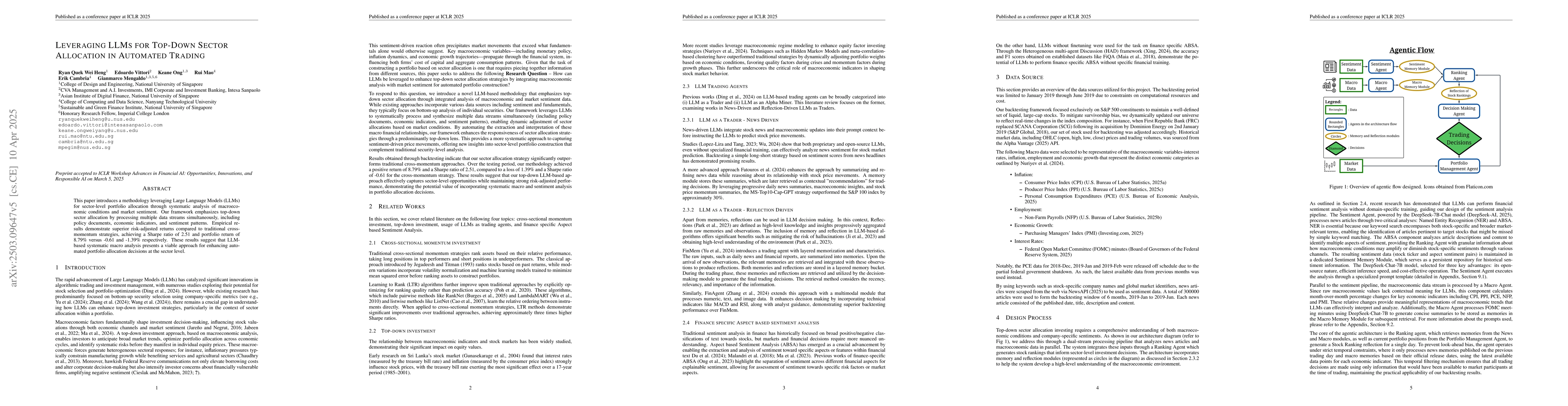

Leveraging LLMS for Top-Down Sector Allocation In Automated Trading

This paper introduces a methodology leveraging Large Language Models (LLMs) for sector-level portfolio allocation through systematic analysis of macroeconomic conditions and market sentiment. Our fram...