Summary

This paper introduces a methodology leveraging Large Language Models (LLMs) for sector-level portfolio allocation through systematic analysis of macroeconomic conditions and market sentiment. Our framework emphasizes top-down sector allocation by processing multiple data streams simultaneously, including policy documents, economic indicators, and sentiment patterns. Empirical results demonstrate superior risk-adjusted returns compared to traditional cross momentum strategies, achieving a Sharpe ratio of 2.51 and portfolio return of 8.79% versus -0.61 and -1.39% respectively. These results suggest that LLM-based systematic macro analysis presents a viable approach for enhancing automated portfolio allocation decisions at the sector level.

AI Key Findings

Generated Jun 10, 2025

Methodology

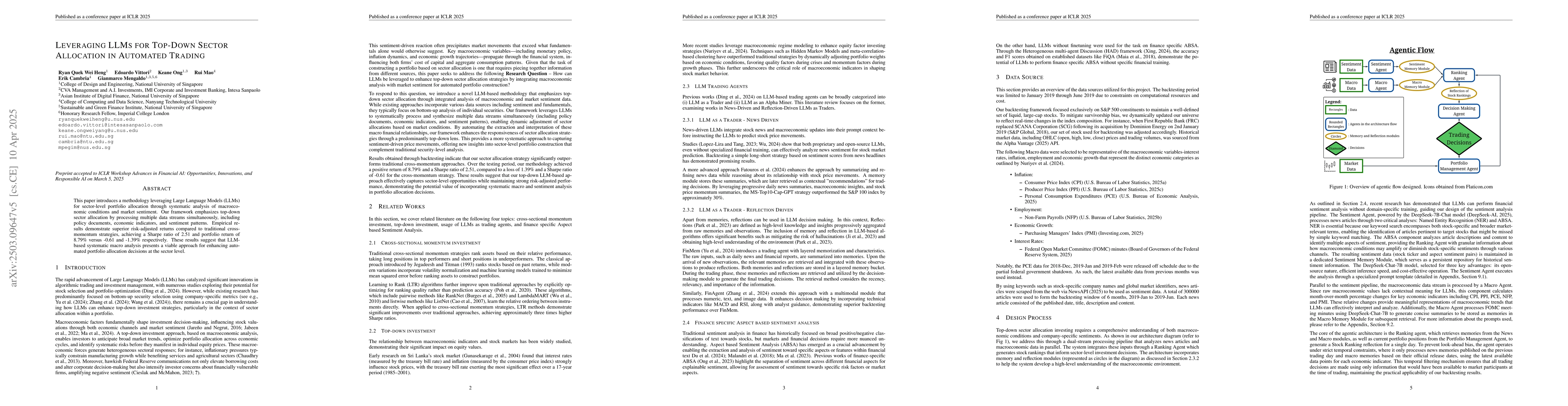

The paper introduces a methodology leveraging Large Language Models (LLMs) for top-down sector allocation in automated trading, processing multiple data streams including policy documents, economic indicators, and sentiment patterns.

Key Results

- The LLM-based systematic macro analysis achieved a Sharpe ratio of 2.51 and portfolio return of 8.79%.

- The strategy significantly outperformed traditional cross-momentum approaches, which recorded a -1.39% return and -0.61 Sharpe ratio.

- The approach demonstrated the ability of LLMs to process and synthesize multiple data streams simultaneously, enabling dynamic sector allocation adjustments based on market conditions.

Significance

This research is important as it presents a viable approach for enhancing automated portfolio allocation decisions at the sector level, showcasing the potential of LLMs in complementing existing investment strategies by providing a more systematic approach to sector-level portfolio construction.

Technical Contribution

The paper demonstrates the effectiveness of LLMs in processing unstructured data and identifying macro-financial relationships, representing a step forward in automating complex market analysis tasks.

Novelty

The novelty of this work lies in its integration of LLMs for top-down sector allocation through systematic analysis of macroeconomic conditions and market sentiment, outperforming traditional cross-momentum strategies in terms of risk-adjusted returns.

Limitations

- The backtesting period from 2019 to 2024 is relatively short, constrained by computational resources and costs.

- The current implementation could benefit from larger language models, which have demonstrated superior capabilities in complex Natural Language Processing tasks.

Future Work

- Expanding the model’s data input to include company fundamental data, such as quarterly earnings reports, to see if incorporating bottom-up financial metrics alongside the top-down approach yields meaningful improvements in portfolio performance.

- Enhancing the ranking mechanism through the implementation of Learning to Rank (LTR) algorithms or Reinforcement Learning techniques to dynamically optimize allocation decisions and enhance adaptability to changing market conditions.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTop-down Automated Theorem Proving (Notes for Sir Timothy)

C. E. Larson, N. Van Cleemput

Holistic Automated Red Teaming for Large Language Models through Top-Down Test Case Generation and Multi-turn Interaction

Songlin Hu, Yan Zhou, Jinchuan Zhang et al.

No citations found for this paper.

Comments (0)