Summary

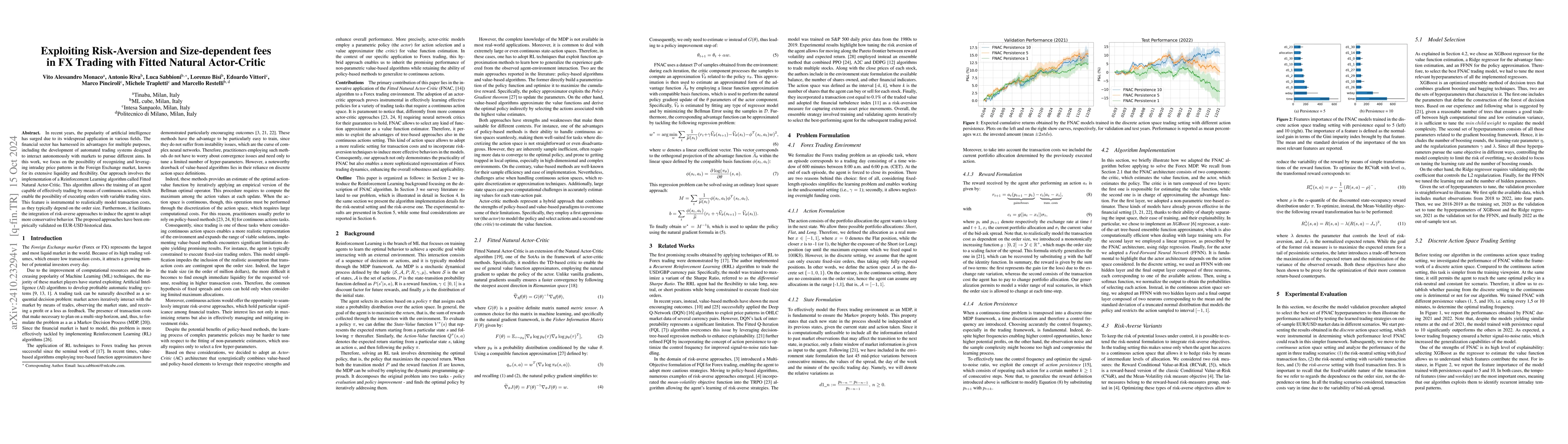

In recent years, the popularity of artificial intelligence has surged due to its widespread application in various fields. The financial sector has harnessed its advantages for multiple purposes, including the development of automated trading systems designed to interact autonomously with markets to pursue different aims. In this work, we focus on the possibility of recognizing and leveraging intraday price patterns in the Foreign Exchange market, known for its extensive liquidity and flexibility. Our approach involves the implementation of a Reinforcement Learning algorithm called Fitted Natural Actor-Critic. This algorithm allows the training of an agent capable of effectively trading by means of continuous actions, which enable the possibility of executing orders with variable trading sizes. This feature is instrumental to realistically model transaction costs, as they typically depend on the order size. Furthermore, it facilitates the integration of risk-averse approaches to induce the agent to adopt more conservative behavior. The proposed approaches have been empirically validated on EUR-USD historical data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFinite-Time Analysis of Three-Timescale Constrained Actor-Critic and Constrained Natural Actor-Critic Algorithms

Shalabh Bhatnagar, Prashansa Panda

Non-Asymptotic Analysis for Single-Loop (Natural) Actor-Critic with Compatible Function Approximation

Yue Wang, Yi Zhou, Yudan Wang et al.

No citations found for this paper.

Comments (0)