Summary

Recent deep reinforcement learning (DRL) methods in finance show promising outcomes. However, there is limited research examining the behavior of these DRL algorithms. This paper aims to investigate their tendencies towards holding or trading financial assets as well as purchase diversity. By analyzing their trading behaviors, we provide insights into the decision-making processes of DRL models in finance applications. Our findings reveal that each DRL algorithm exhibits unique trading patterns and strategies, with A2C emerging as the top performer in terms of cumulative rewards. While PPO and SAC engage in significant trades with a limited number of stocks, DDPG and TD3 adopt a more balanced approach. Furthermore, SAC and PPO tend to hold positions for shorter durations, whereas DDPG, A2C, and TD3 display a propensity to remain stationary for extended periods.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

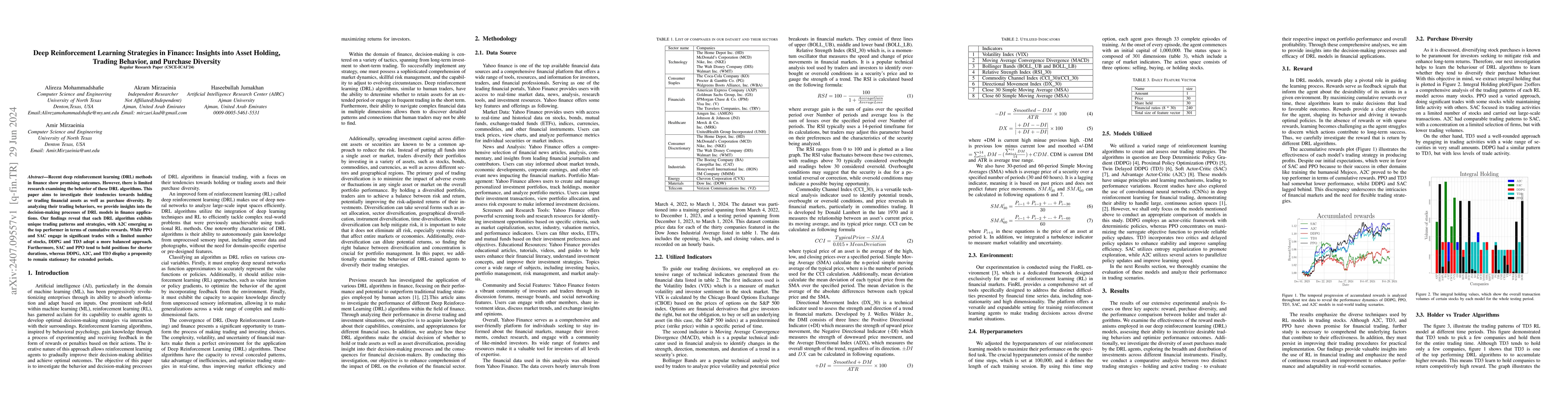

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFinRL: A Deep Reinforcement Learning Library for Automated Stock Trading in Quantitative Finance

Qian Chen, Liuqing Yang, Xiao-Yang Liu et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)