Authors

Summary

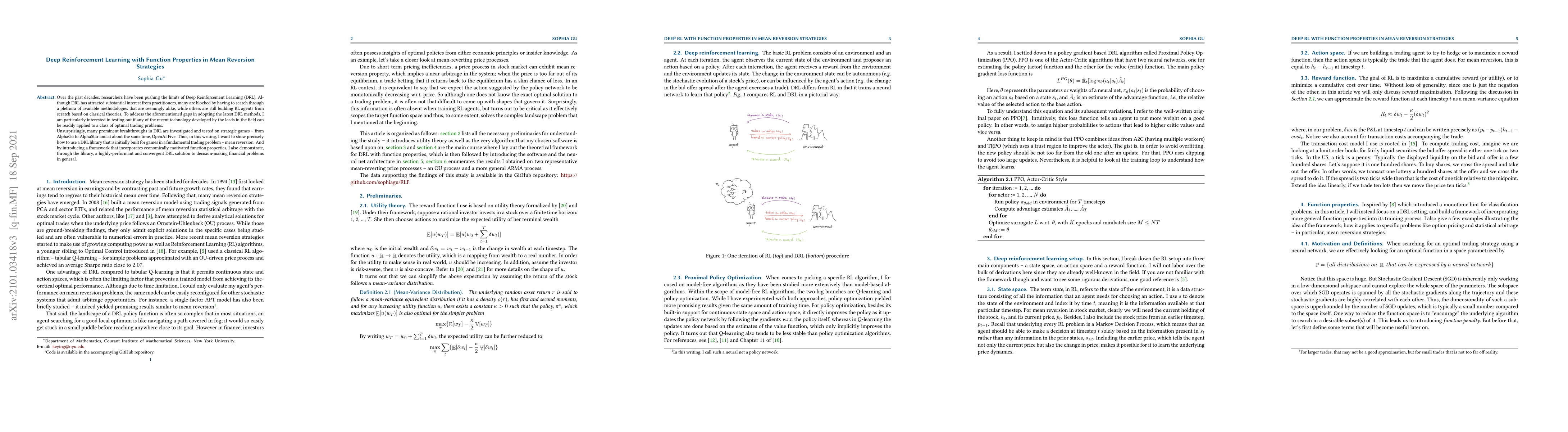

Over the past decades, researchers have been pushing the limits of Deep Reinforcement Learning (DRL). Although DRL has attracted substantial interest from practitioners, many are blocked by having to search through a plethora of available methodologies that are seemingly alike, while others are still building RL agents from scratch based on classical theories. To address the aforementioned gaps in adopting the latest DRL methods, I am particularly interested in testing out if any of the recent technology developed by the leads in the field can be readily applied to a class of optimal trading problems. Unsurprisingly, many prominent breakthroughs in DRL are investigated and tested on strategic games: from AlphaGo to AlphaStar and at about the same time, OpenAI Five. Thus, in this writing, I want to show precisely how to use a DRL library that is initially built for games in a fundamental trading problem; mean reversion. And by introducing a framework that incorporates economically-motivated function properties, I also demonstrate, through the library, a highly-performant and convergent DRL solution to decision-making financial problems in general.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep Reinforcement Learning and Mean-Variance Strategies for Responsible Portfolio Optimization

Manuela Veloso, Fernando Acero, Parisa Zehtabi et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)