Summary

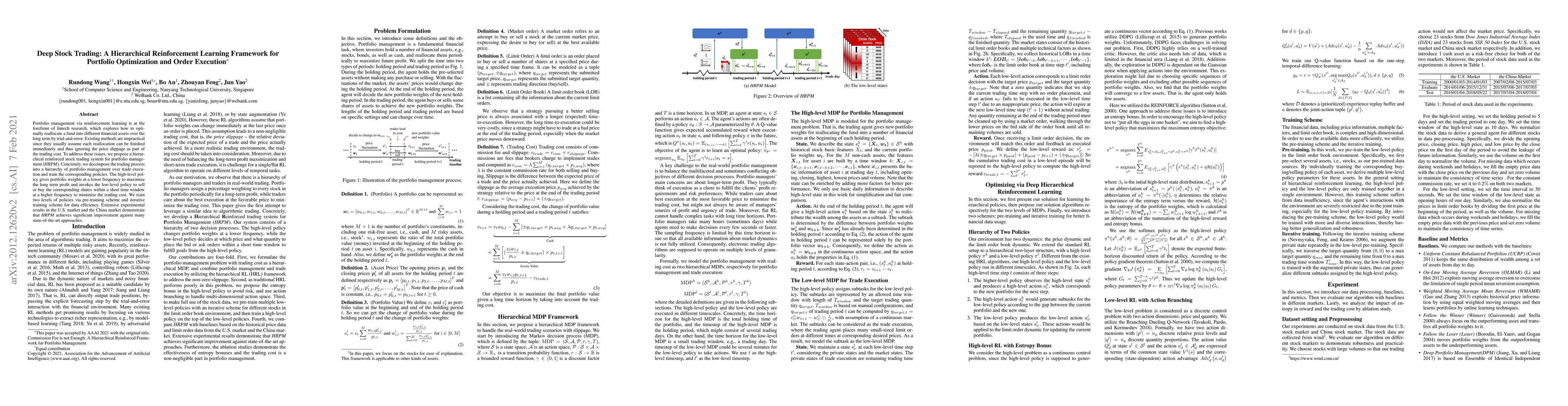

Portfolio management via reinforcement learning is at the forefront of fintech research, which explores how to optimally reallocate a fund into different financial assets over the long term by trial-and-error. Existing methods are impractical since they usually assume each reallocation can be finished immediately and thus ignoring the price slippage as part of the trading cost. To address these issues, we propose a hierarchical reinforced stock trading system for portfolio management (HRPM). Concretely, we decompose the trading process into a hierarchy of portfolio management over trade execution and train the corresponding policies. The high-level policy gives portfolio weights at a lower frequency to maximize the long term profit and invokes the low-level policy to sell or buy the corresponding shares within a short time window at a higher frequency to minimize the trading cost. We train two levels of policies via pre-training scheme and iterative training scheme for data efficiency. Extensive experimental results in the U.S. market and the China market demonstrate that HRPM achieves significant improvement against many state-of-the-art approaches.

AI Key Findings - Failed

Key findings generation failed. Failed to start generation process

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPractical Deep Reinforcement Learning Approach for Stock Trading

Xiao-Yang Liu, Shan Zhong, Hongyang Yang et al.

Multimodal Deep Reinforcement Learning for Portfolio Optimization

James Zhang, Sumit Nawathe, Ravi Panguluri et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)