Summary

Recent studies have demonstrated the efficiency of Variational Autoencoders (VAE) to compress high-dimensional implied volatility surfaces into a low dimensional representation. Although this method can be effectively used for pricing vanilla options, it does not provide any explicit information about the dynamics of the underlying asset. In our work we present an effective way to overcome this problem. We use a Weighted Monte Carlo approach to first generate paths from a simple a priori Brownian dynamics, and then calculate path weights to price options correctly. We develop and successfully train a neural network that is able to assign these weights directly from the latent space. Combining the encoder network of the VAE and this new "weight assigner" module, we are able to build a dynamic pricing framework which cleanses the volatility surface from irrelevant noise fluctuations, and then can price not just vanillas, but also exotic options on this idealized vol surface. This pricing method can provide relative value signals for option traders.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

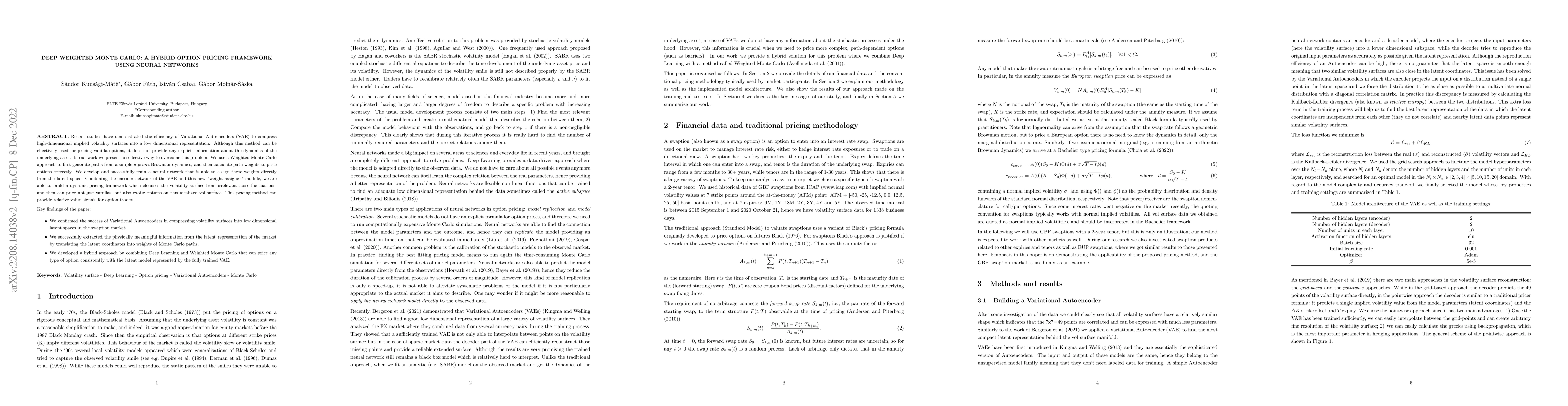

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)