Summary

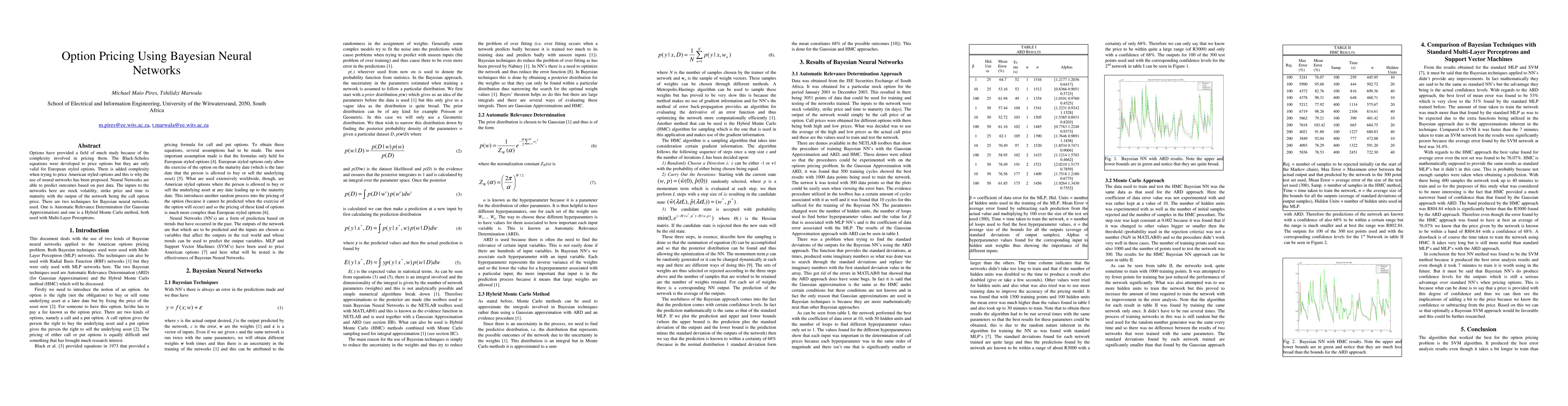

Options have provided a field of much study because of the complexity involved in pricing them. The Black-Scholes equations were developed to price options but they are only valid for European styled options. There is added complexity when trying to price American styled options and this is why the use of neural networks has been proposed. Neural Networks are able to predict outcomes based on past data. The inputs to the networks here are stock volatility, strike price and time to maturity with the output of the network being the call option price. There are two techniques for Bayesian neural networks used. One is Automatic Relevance Determination (for Gaussian Approximation) and one is a Hybrid Monte Carlo method, both used with Multi-Layer Perceptrons.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersJump Diffusion-Informed Neural Networks with Transfer Learning for Accurate American Option Pricing under Data Scarcity

Yuwei Zhang, Qiguo Sun, Hanyue Huang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)