Summary

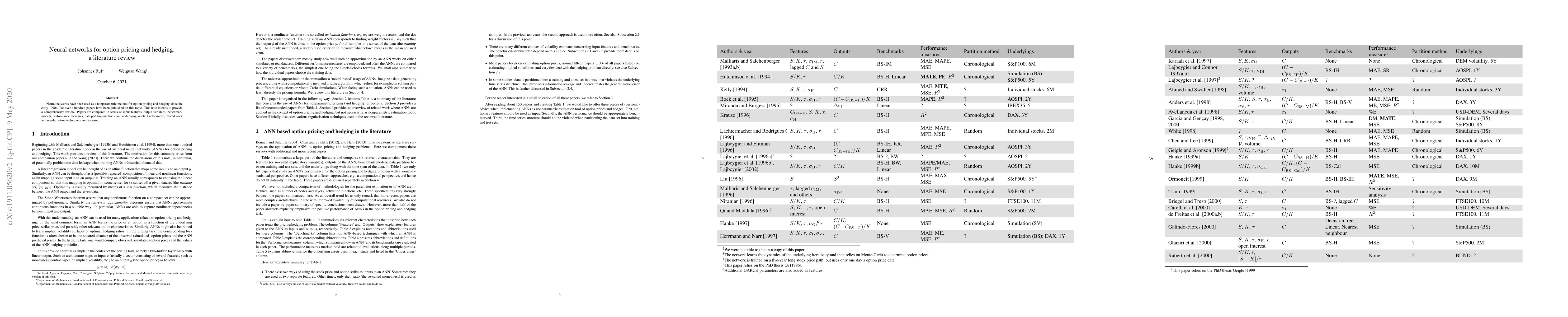

Neural networks have been used as a nonparametric method for option pricing and hedging since the early 1990s. Far over a hundred papers have been published on this topic. This note intends to provide a comprehensive review. Papers are compared in terms of input features, output variables, benchmark models, performance measures, data partition methods, and underlying assets. Furthermore, related work and regularisation techniques are discussed.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersApplying Reinforcement Learning to Option Pricing and Hedging

Zoran Stoiljkovic

Option pricing and hedging for regime-switching geometric Brownian motion models

Bruno Remillard, Sylvain Rubenthaler

| Title | Authors | Year | Actions |

|---|

Comments (0)