Authors

Summary

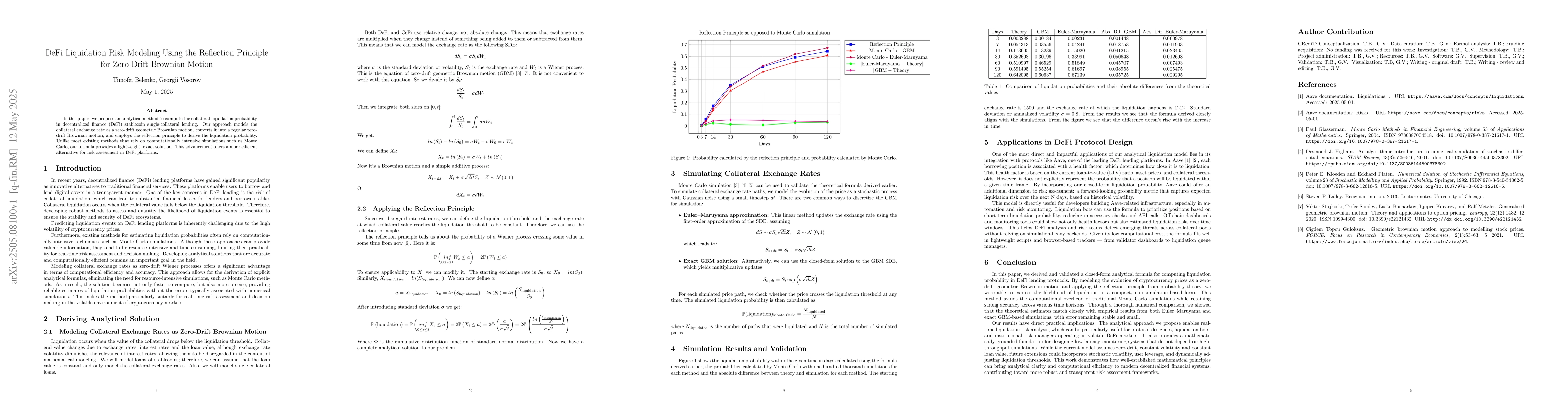

In this paper, we propose an analytical method to compute the collateral liquidation probability in decentralized finance (DeFi) stablecoin single-collateral lending. Our approach models the collateral exchange rate as a zero-drift geometric Brownian motion, converts it into a regular zero-drift Brownian motion, and employs the reflection principle to derive the liquidation probability. Unlike most existing methods that rely on computationally intensive simulations such as Monte Carlo, our formula provides a lightweight, exact solution. This advancement offers a more efficient alternative for risk assessment in DeFi platforms.

AI Key Findings

Generated Jun 08, 2025

Methodology

The paper proposes an analytical method using the reflection principle for zero-drift Brownian motion to compute collateral liquidation probability in DeFi stablecoin single-collateral lending, contrasting with computationally intensive simulation methods like Monte Carlo.

Key Results

- An exact formula for liquidation probability derived from a zero-drift geometric Brownian motion model of collateral exchange rate.

- The method offers a lightweight, computationally efficient alternative for risk assessment in DeFi platforms.

Significance

This research provides a more efficient tool for risk assessment in DeFi, potentially improving platform stability and user confidence by offering precise, real-time liquidation risk estimations.

Technical Contribution

Introduction of an analytical formula for liquidation risk using the reflection principle on zero-drift Brownian motion, contrasting with existing simulation-based methods.

Novelty

The paper's novelty lies in providing an exact, computationally efficient solution for liquidation risk in DeFi, unlike previous simulation-heavy approaches.

Limitations

- The model assumes a stablecoin environment, which may not generalize to all cryptocurrencies.

- It relies on the geometric Brownian motion assumption, which might not capture all market dynamics.

Future Work

- Explore applicability to various cryptocurrencies beyond stablecoins.

- Investigate incorporating more complex motion models to capture a broader range of market behaviors.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)