Authors

Summary

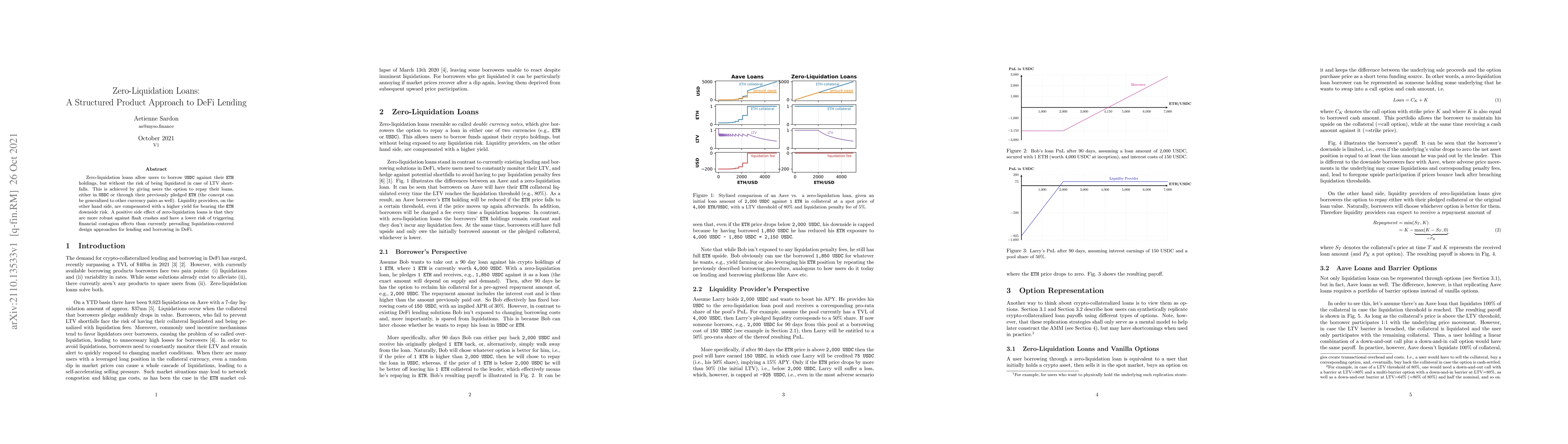

Zero-Liquidation loans allow DeFi users to borrow USDC against their ETH holdings, but without the risk of being liquidated in case of LTV shortfalls. This is achieved by giving users the option to repay their loans, either in USDC or through their previously pledged ETH (the concept can be generalized to other currency pairs as well). Liquidity providers, on the other hand side, are compensated with a higher yield for bearing the ETH downside risk. A positive side effect of zero-liquidation loans is that they are more robust against flash crashes and have a lower financial contagion effect than current lending and borrowing protocols.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA multi-asset, agent-based approach applied to DeFi lending protocol modelling

Amit Chaudhary, Daniele Pinna

DeFi Liquidation Risk Modeling Using the Reflection Principle for Zero-Drift Brownian Motion

Timofei Belenko, Georgii Vosorov

| Title | Authors | Year | Actions |

|---|

Comments (0)