Authors

Summary

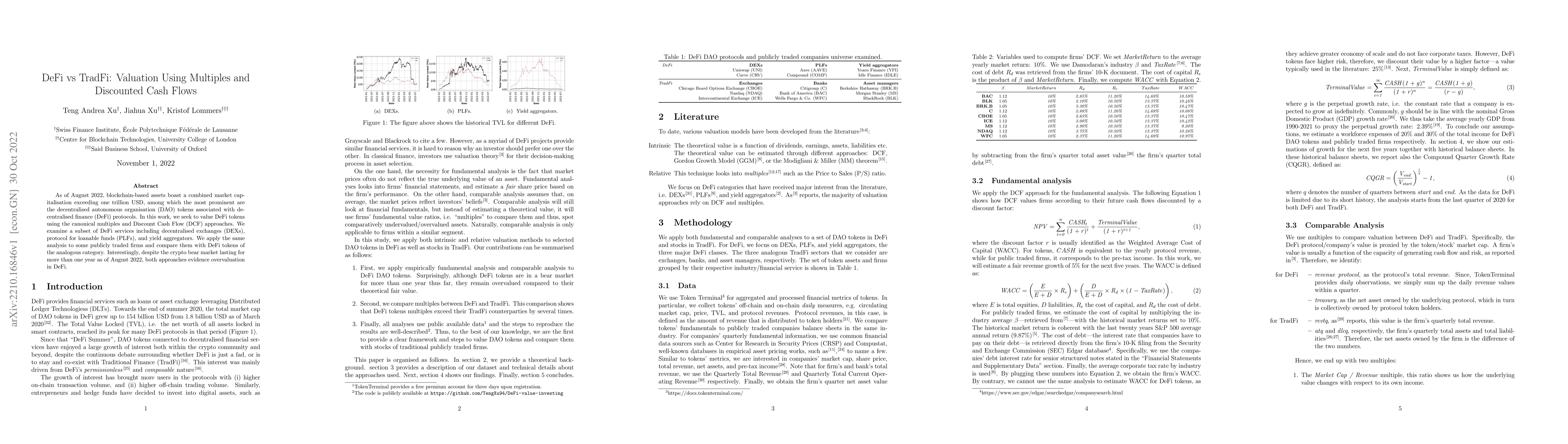

As of August 2022, blockchain-based assets boast a combined market capitalisation exceeding one trillion USD, among which the most prominent are the decentralised autonomous organisation (DAO) tokens associated with decentralised finance (DeFi) protocols. In this work, we seek to value DeFi tokens using the canonical multiples and Discount Cash Flow (DCF) approaches. We examine a subset of DeFi services including decentralised exchanges (DEXs), protocol for loanable funds (PLFs), and yield aggregators. We apply the same analysis to some publicly traded firms and compare them with DeFi tokens of the analogous category. Interestingly, despite the crypto bear market lasting for more than one year as of August 2022, both approaches evidence overvaluation in DeFi.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)