Summary

This paper closely examines theoretical and practical aspects of the widely used discounted cash flows (DCF) valuation method. It assesses its potentials as well as several weaknesses. A special emphasize is being put on the valuation of companies using the DCF method. The paper finds that the discounted cash flow method is a powerful tool to analyze even complex situations. However, the DCF method is subject to massive assumption bias and even slight changes in the underlying assumptions of an analysis can drastically alter the valuation results. A practical example of these implications is given using a scenario analysis.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

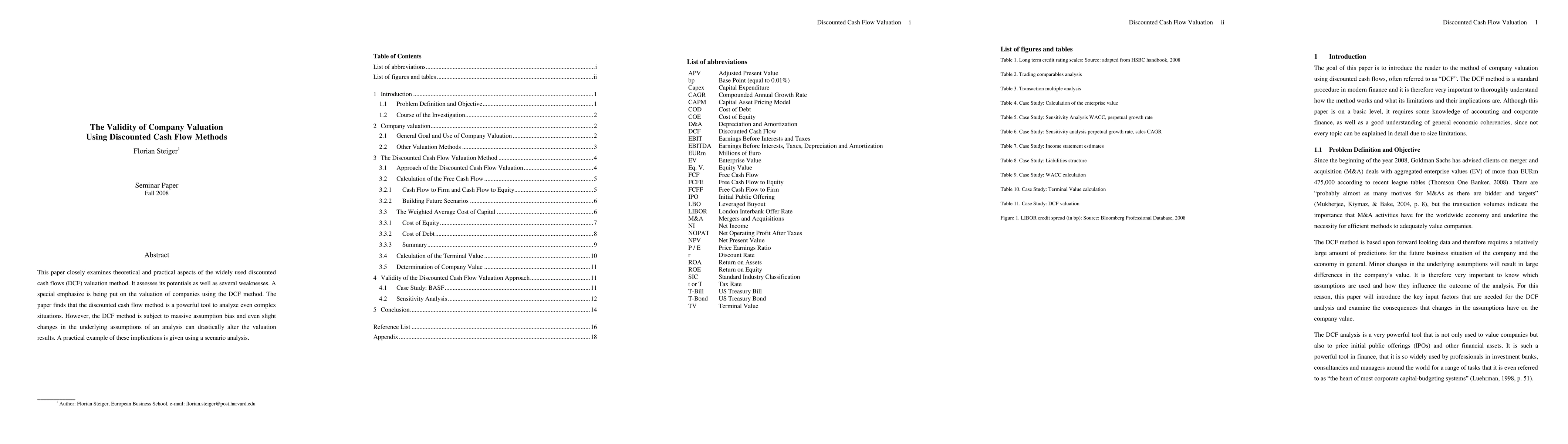

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeFi vs TradFi: Valuation Using Multiples and Discounted Cash Flow

Jiahua Xu, Teng Andrea Xu, Kristof Lommers

| Title | Authors | Year | Actions |

|---|

Comments (0)