Authors

Summary

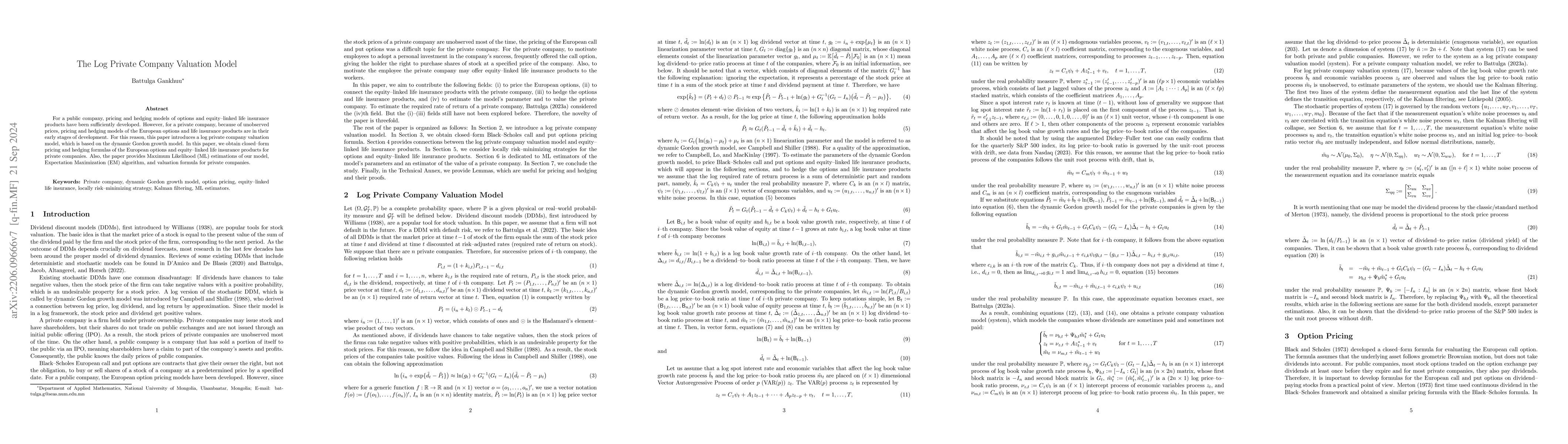

For a public company, pricing and hedging models of options and equity--linked life insurance products have been sufficiently developed. However, for a private company, because of unobserved prices, pricing and hedging models of the European options and life insurance products are in their early stages of development. For this reason, this paper introduces a log private company valuation model, which is based on the dynamic Gordon growth model. In this paper, we obtain closed--form pricing and hedging formulas of the European options and equity--linked life insurance products for private companies. Also, the paper provides Maximum Likelihood (ML) estimators of our model, Expectation Maximization (EM) algorithm, and valuation formula for private companies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCost Sharing under Private Valuation and Connection Control

Tianyi Zhang, Junyu Zhang, Dengji Zhao et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)