Authors

Summary

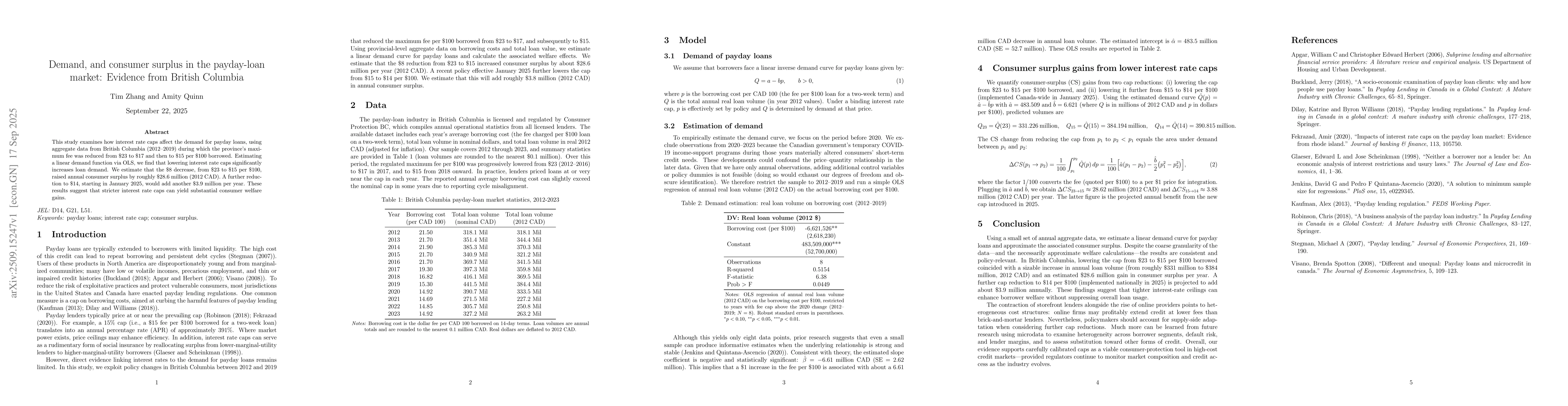

This study examines how interest rate caps affect the demand for payday loans, using aggregate data from British Columbia (2012--2019) during which the province's maximum fee was reduced from \$23 to \$17 and then to \$15 per \$100 borrowed. Estimating a linear demand function via OLS, we find that lowering interest rate caps significantly increases loan demand. We estimate that the \$8 decrease, from \$23 to \$15 per \$100, raised annual consumer surplus by roughly \$28.6 million (2012 CAD). A further reduction to \$14, starting in January 2025, would add another \$3.9 million per year. These results suggest that stricter interest rate caps can yield substantial consumer welfare gains.

AI Key Findings

Generated Sep 30, 2025

Methodology

The study uses OLS regression on annual aggregated data from British Columbia (2012-2019) to estimate a linear demand function for payday loans, analyzing the impact of interest rate caps on loan demand and consumer surplus.

Key Results

- Lowering interest rate caps from $23 to $15 per $100 borrowed increased annual consumer surplus by approximately $28.6 million in 2012 CAD.

- A further reduction to $14 per $100, effective January 2025, is projected to add about $3.9 million annually to consumer surplus.

- The estimated demand curve shows a negative and statistically significant slope coefficient, indicating that higher fees are associated with lower loan volumes.

Significance

This research highlights the potential welfare gains from stricter interest rate caps in high-cost credit markets, providing evidence for policymakers to consider regulatory adjustments that enhance consumer protection without suppressing loan usage.

Technical Contribution

The paper develops a method to estimate consumer surplus gains from interest rate cap reductions using a linear demand function derived from aggregated data, offering a practical approach for policy evaluation.

Novelty

This work is novel in applying OLS regression to aggregated payday loan data to quantify consumer surplus changes from interest rate cap adjustments, providing empirical evidence for regulatory impact analysis.

Limitations

- The study uses annual aggregated data, which may obscure micro-level variations and individual borrower behaviors.

- Excluding data from 2020-2023 due to the impact of the COVID-19 pandemic limits the analysis to a shorter time frame and may affect the robustness of findings.

Future Work

- Further research using microdata could examine heterogeneity across borrower segments, default risk, and lender margins.

- Investigating substitution effects toward other forms of credit could provide insights into market dynamics and consumer behavior.

- Analyzing the long-term impacts of interest rate caps on both consumer welfare and lender behavior could enhance policy design.

Paper Details

PDF Preview

Similar Papers

Found 4 papersOptimal Mechanisms for Consumer Surplus Maximization

Tomer Ezra, Ariel Shaulker, Daniel Schoepflin

Detecting Consumers' Financial Vulnerability using Open Banking Data: Evidence from UK Payday Loans

Victor Medina-Olivares, Raffaella Calabrese

Estimating the Number of Opioid Overdoses in British Columbia Using Relational Evidence with Tree Structure

Paul Gustafson, Mallory J Flynn, Michael A. Irvine

Comments (0)