Summary

1. A recent unpublished manuscript whose conclusions were widely circulated in the electronic media (Zinman, 2009) claimed that Oregon 2007 payday loan (PL) rate-limiting regulations (hereafter, "Cap") have hurt borrowers. 2. The report's main conclusion, phrased in cause-and-effect language in the abstract - "...restricting access caused deterioration in the overall financial condition of the Oregon households..." - relies on a single, small-sample survey funded by the payday-lending industry (PLI). The survey is fraught with methodological flaws. 3. Moreover, survey results do not support the claim that Oregon borrowers fared worse than Washington borrowers, on any variable that can be plausibly attributed to the Cap. 4. In fact, Oregon respondents fared better than Washington respondents on two key variables: on-time bill payment rate and avoiding phone-line disconnects. On all other relevant variables they fared similarly to Washington respondents. In short, the reported claim is baseless.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

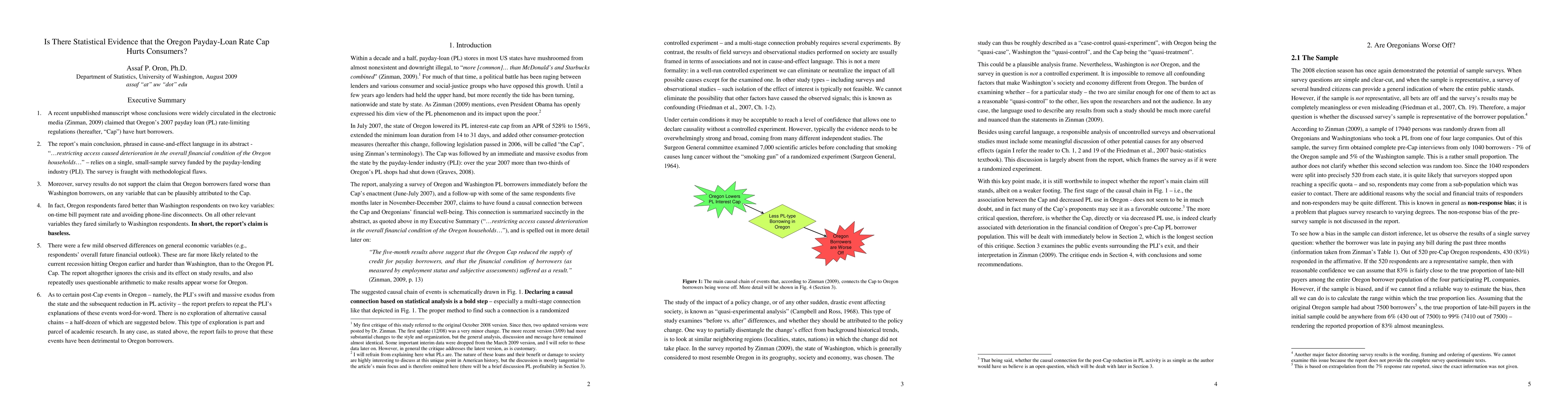

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDetecting Consumers' Financial Vulnerability using Open Banking Data: Evidence from UK Payday Loans

Victor Medina-Olivares, Raffaella Calabrese

Demand and consumer surplus in the payday-loan market: Evidence from British Columbia

Tim Zhang, Amity Quinn

No citations found for this paper.

Comments (0)