Summary

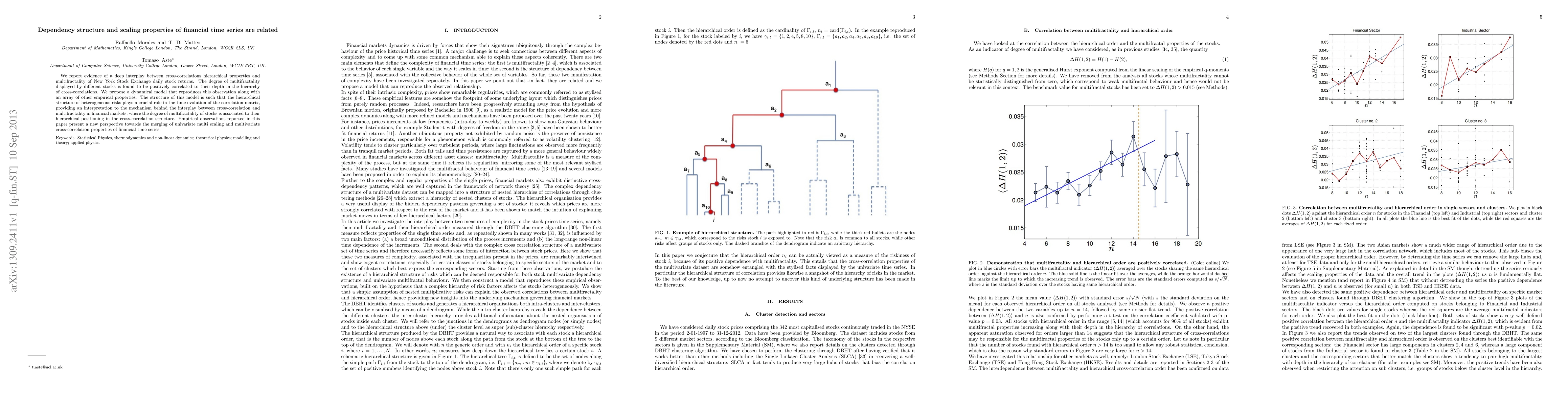

We report evidence of a deep interplay between cross-correlations hierarchical properties and multifractality of New York Stock Exchange daily stock returns. The degree of multifractality displayed by different stocks is found to be positively correlated to their depth in the hierarchy of cross-correlations. We propose a dynamical model that reproduces this observation along with an array of other empirical properties. The structure of this model is such that the hierarchical structure of heterogeneous risks plays a crucial role in the time evolution of the correlation matrix, providing an interpretation to the mechanism behind the interplay between cross-correlation and multifractality in financial markets, where the degree of multifractality of stocks is associated to their hierarchical positioning in the cross-correlation structure. Empirical observations reported in this paper present a new perspective towards the merging of univariate multi scaling and multivariate cross-correlation properties of financial time series.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)