Summary

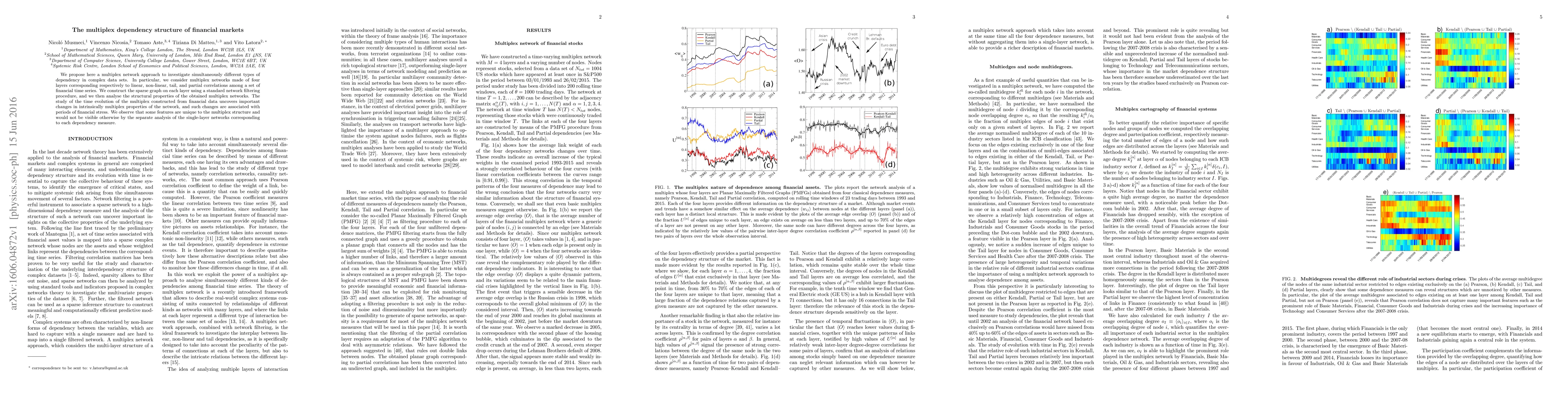

We propose here a multiplex network approach to investigate simultaneously different types of dependency in complex data sets. In particular, we consider multiplex networks made of four layers corresponding respectively to linear, non-linear, tail, and partial correlations among a set of financial time series. We construct the sparse graph on each layer using a standard network filtering procedure, and we then analyse the structural properties of the obtained multiplex networks. The study of the time evolution of the multiplex constructed from financial data uncovers important changes in intrinsically multiplex properties of the network, and such changes are associated with periods of financial stress. We observe that some features are unique to the multiplex structure and would not be visible otherwise by the separate analysis of the single-layer networks corresponding to each dependency measure.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTesting for asymmetric dependency structures in financial markets: regime-switching and local Gaussian correlation

Kristian Gundersen, Timothée Bacri, Jan Bulla et al.

A tensor-based unified approach for clustering coefficients in financial multiplex networks

Paolo Bartesaghi, Rosanna Grassi, Gian Paolo Clemente

| Title | Authors | Year | Actions |

|---|

Comments (0)