Summary

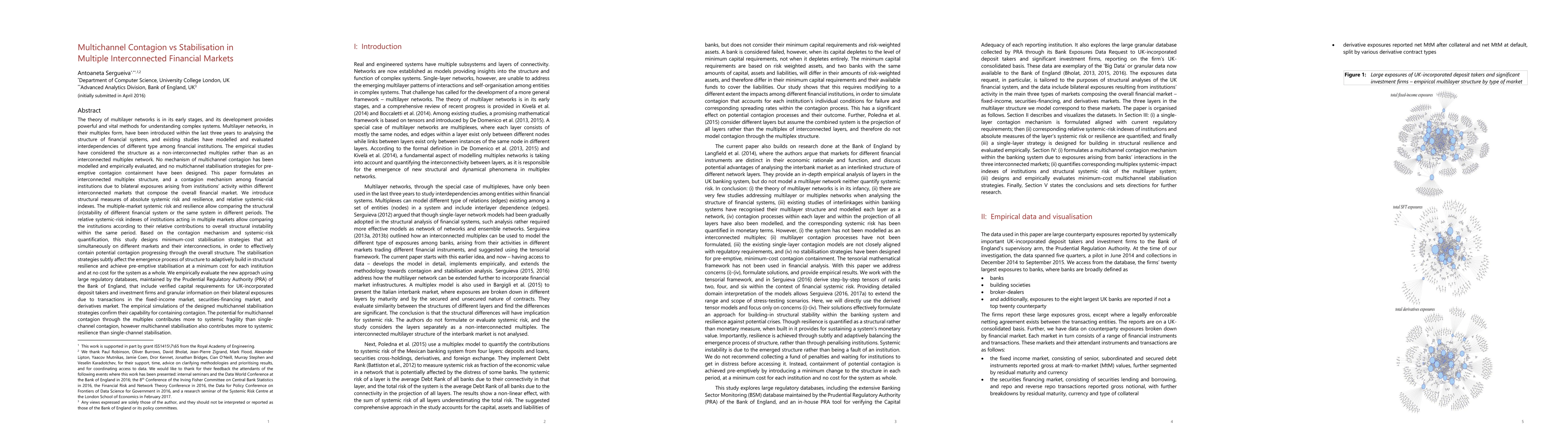

The theory of multilayer networks is in its early stages, and its development provides vital methods for understanding complex systems. Multilayer networks, in their multiplex form, have been introduced within the last three years to analysing the structure of financial systems, and existing studies have modelled and evaluated interdependencies of different type among financial institutions. These studies, however, have considered the structure as a non-interconnected multiplex - an ensemble of single layer networks comprising the same nodes - rather than as an interconnected multiplex network. No mechanism of multichannel contagion has been modelled and empirically evaluated, and no multichannel stabilisation strategies for pre-emptive contagion containment have been designed. This paper formulates an interconnected multiplex structure, and a contagion mechanism among financial institutions due to bilateral exposures arising from institutions activity within different interconnected markets that compose the overall financial market. We introduce structural measures of absolute systemic risk and resilience, and relative systemic-risk indexes. Based on the contagion mechanism and systemic-risk quantification, this study designs minimum-cost stabilisation strategies that act simultaneously on different markets and their interconnections, in order to effectively contain potential contagion progressing through the overall structure. The stabilisation strategies subtly affect the emergence process of structure to adaptively build in structural resilience and achieve pre-emptive stabilisation at a minimum cost for each institution and at no cost for the system as a whole. We empirically evaluate the new approach using large granular databases, maintained by the Prudential Regulatory Authority of the Bank of England. The capabilities of multichannel stabilisation are confirmed empirically.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)