Summary

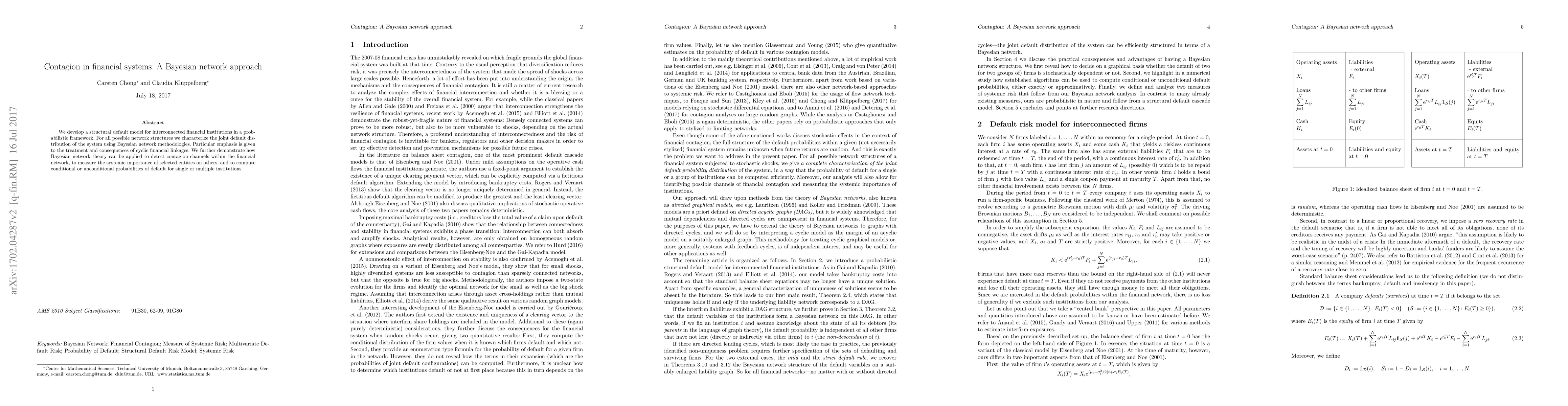

We develop a structural default model for interconnected financial institutions in a probabilistic framework. For all possible network structures we characterize the joint default distribution of the system using Bayesian network methodologies. Particular emphasis is given to the treatment and consequences of cyclic financial linkages. We further demonstrate how Bayesian network theory can be applied to detect contagion channels within the financial network, to measure the systemic importance of selected entities on others, and to compute conditional or unconditional probabilities of default for single or multiple institutions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)