Summary

One of the most defining features of the global financial network is its inherent complex and intertwined structure. From the perspective of systemic risk it is important to understand the influence of this network structure on default contagion. Using sparse random graphs to model the financial network, asymptotic methods turned out powerful to analytically describe the contagion process and to make statements about resilience. So far, however, they have been limited to so-called {\em rank one} models in which informally the only network parameter is the degree sequence (see (Amini et. al. 2016) and (Detering et. al. 2019) for example) and the contagion process can be described by a one dimensional fix-point equation. These networks fail to account for a pronounced block structure such as core/periphery or a network composed of different connected blocks for different countries. We present a much more general model here, where we distinguish vertices (institutions) of different types and let edge probabilities and exposures depend on the types of both, the receiving and the sending vertex plus additional parameters. Our main result allows to compute explicitly the systemic damage caused by some initial local shock event, and we derive a complete characterisation of resilient respectively non-resilient financial systems. This is the first instance that default contagion is rigorously studied in a model outside the class of rank one models and several technical challenges arise. Moreover, in contrast to previous work, in which networks could be classified as resilient or non resilient, independent of the distribution of the shock, information about the shock becomes important in our model and a more refined resilience condition arises. Among other applications of our theory we derive resilience conditions for the global network based on subnetwork conditions only.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

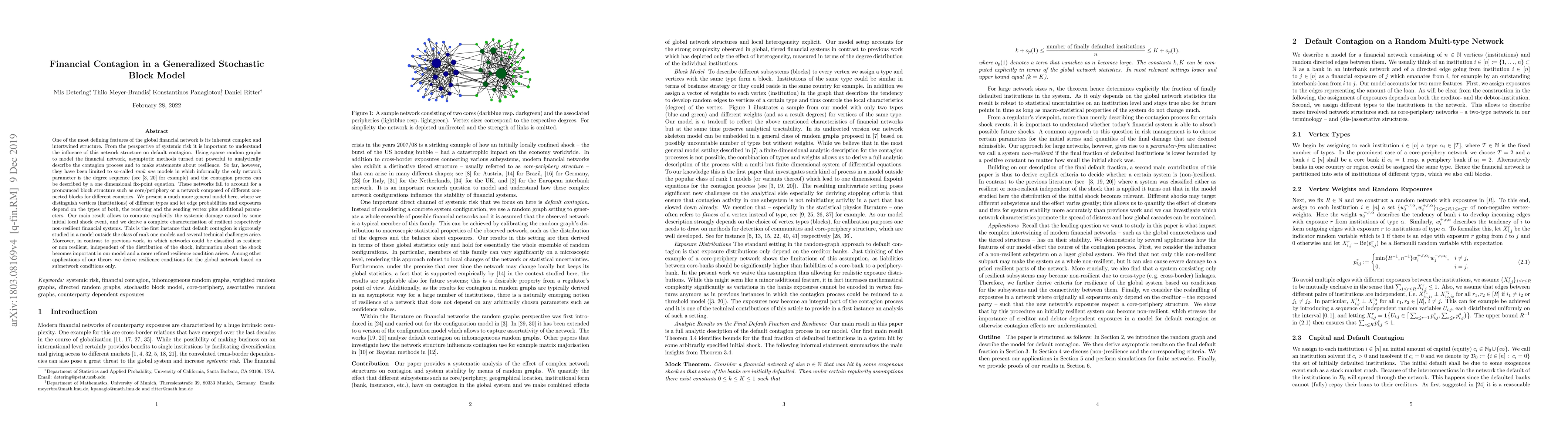

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDynamic Clearing and Contagion in Financial Networks

Zachary Feinstein, Tathagata Banerjee, Alex Bernstein

| Title | Authors | Year | Actions |

|---|

Comments (0)