Summary

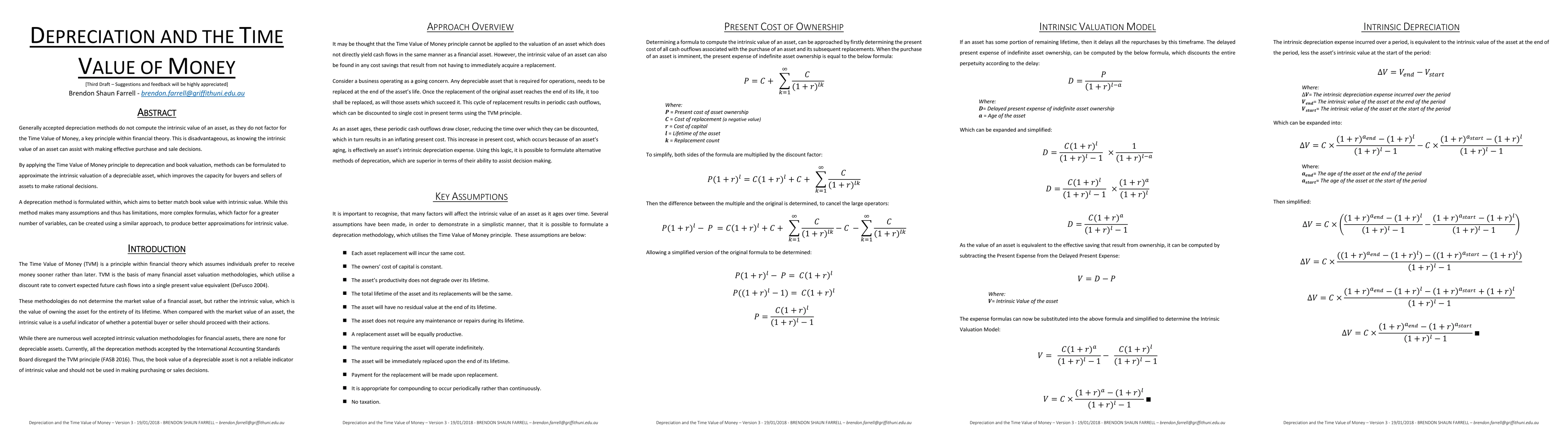

Generally accepted depreciation methods do not compute the intrinsic value of an asset, as they do not factor for the Time Value of Money, a key principle within financial theory. This is disadvantageous, as knowing the intrinsic value of an asset can assist with making effective purchase and sale decisions. By applying the Time Value of Money principle to deprecation and book valuation, methods can be formulated to approximate the intrinsic valuation of a depreciable asset, which improves the capacity for buyers and sellers of assets to make rational decisions. A deprecation method is formulated within, which aims to better match book value with intrinsic value. While this method makes many assumptions and thus has limitations, more complex formulas, which factor for a greater number of variables, can be created using a similar approach, to produce better approximations for intrinsic value.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe Circulation of Money and Holding Time Distribution

Li Zhang, Ning Ding, Yougui Wang

| Title | Authors | Year | Actions |

|---|

Comments (0)