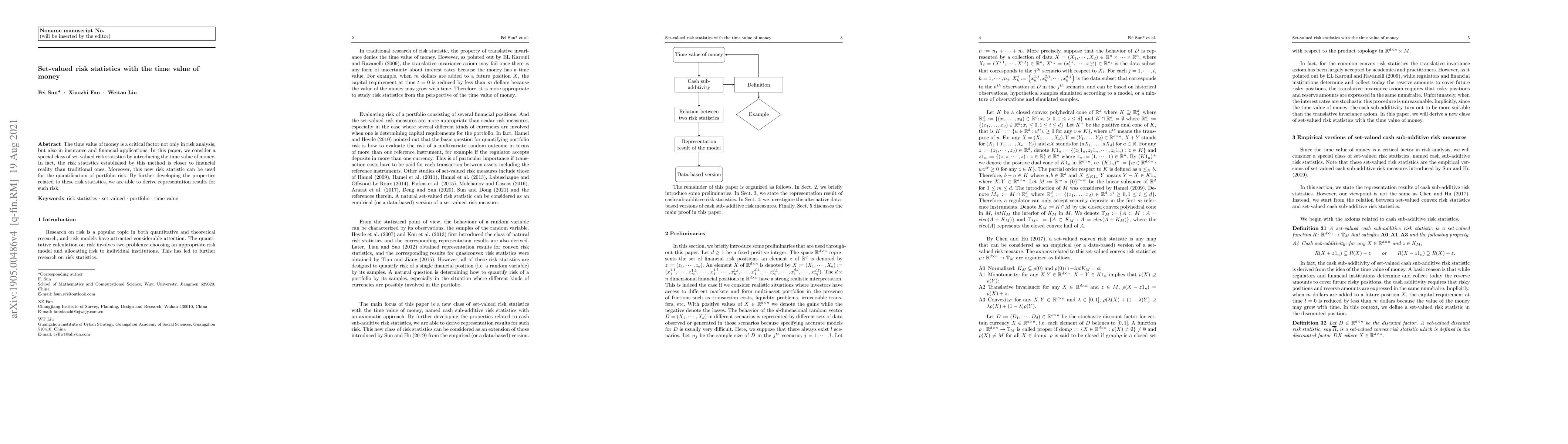

Summary

The time value of money is a critical factor not only in risk analysis, but also in insurance and financial applications. In this paper, we consider a special class of set-valued risk statistics by introducing the time value of money. In fact, the risk statistics established by this method is closer to financial reality than traditional ones. Moreover, this new risk statistic can be uesd for the quantification of portfolio risk. By further developing the properties related to these risk statistics, we are able to derive representation results for such risk.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)