Summary

We propose a design for schedule-based execution trading strategies based on uncertainty bands. This formulation: 1) simplifies strategy specification and implementation; 2) provides for flexible allocation among passive, opportunistic, aggressive, and dark pool crossing execution tactics; 3) allows for rapid enhancements as new optimization methods, scheduling techniques, alpha models, and execution tactics are developed; and 4) yields information at macroscopic (strategic) and microscopic (tactical) levels that is easily published to trading databases and front-end applications.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

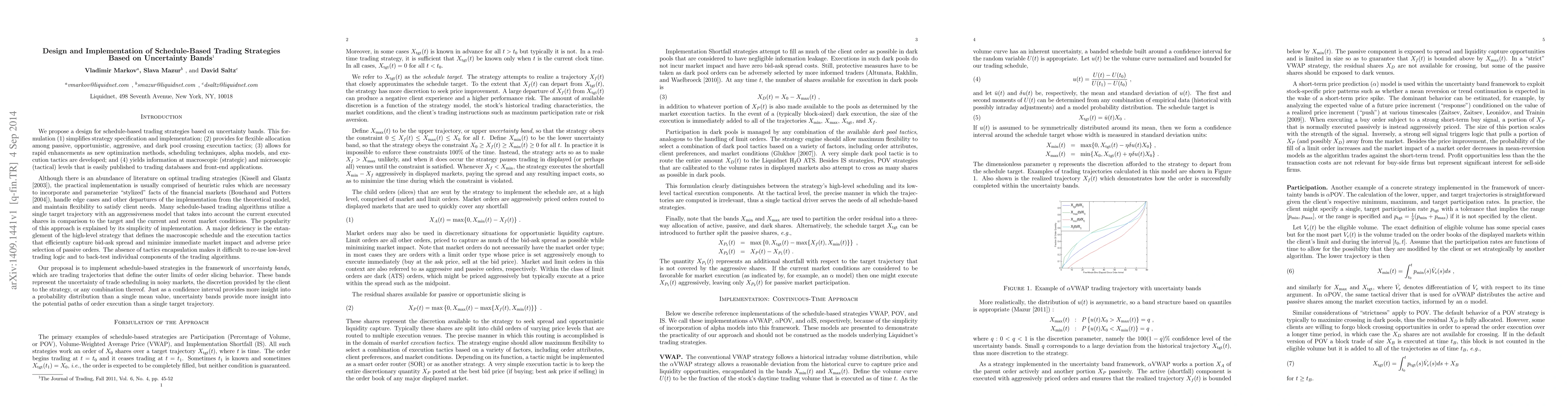

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimizing Quantile-based Trading Strategies in Electricity Arbitrage

Ciaran O'Connor, Joseph Collins, Steven Prestwich et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)