Summary

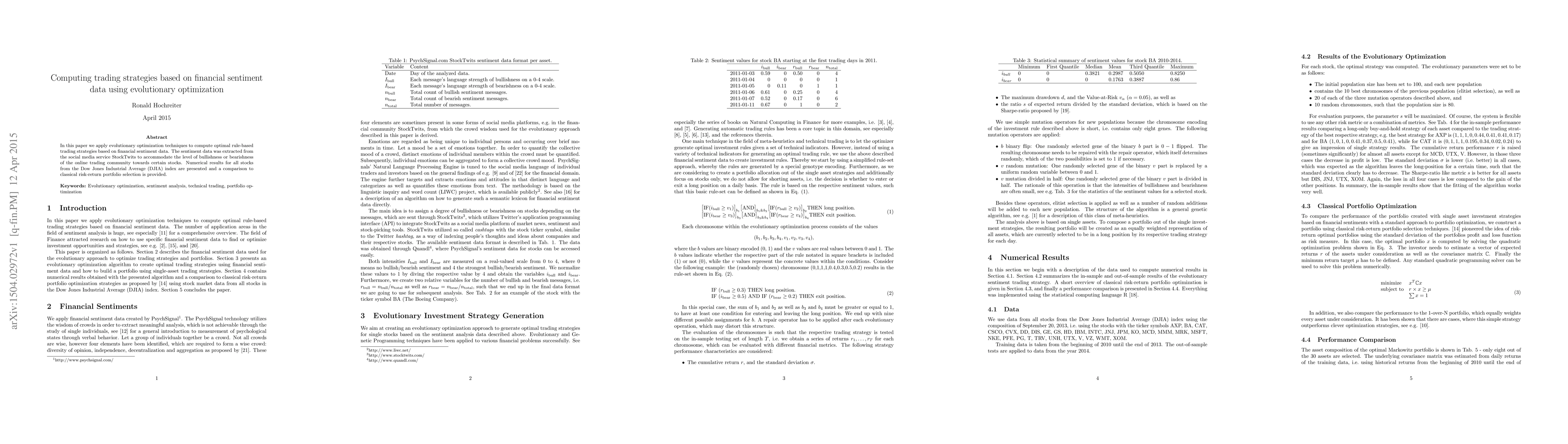

In this paper we apply evolutionary optimization techniques to compute optimal rule-based trading strategies based on financial sentiment data. The sentiment data was extracted from the social media service StockTwits to accommodate the level of bullishness or bearishness of the online trading community towards certain stocks. Numerical results for all stocks from the Dow Jones Industrial Average (DJIA) index are presented and a comparison to classical risk-return portfolio selection is provided.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFinDPO: Financial Sentiment Analysis for Algorithmic Trading through Preference Optimization of LLMs

Wuyang Zhou, Giorgos Iacovides, Danilo Mandic

FinLlama: Financial Sentiment Classification for Algorithmic Trading Applications

Thanos Konstantinidis, Giorgos Iacovides, Mingxue Xu et al.

Backtesting Sentiment Signals for Trading: Evaluating the Viability of Alpha Generation from Sentiment Analysis

Yuxuan Zhao, Elvys Linhares Pontes, Carlos-Emiliano González-Gallardo et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)