Summary

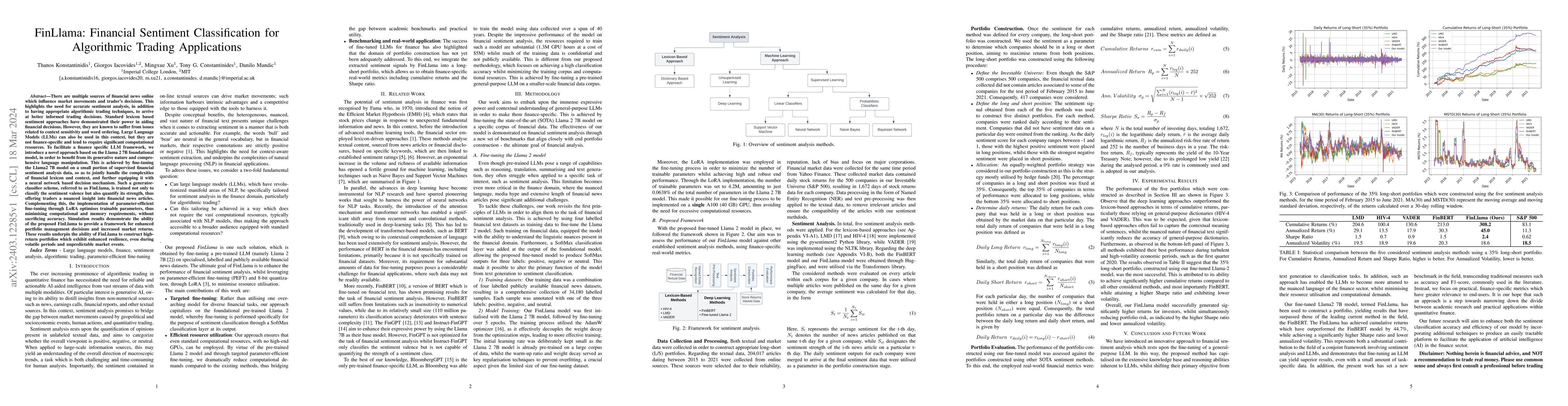

There are multiple sources of financial news online which influence market movements and trader's decisions. This highlights the need for accurate sentiment analysis, in addition to having appropriate algorithmic trading techniques, to arrive at better informed trading decisions. Standard lexicon based sentiment approaches have demonstrated their power in aiding financial decisions. However, they are known to suffer from issues related to context sensitivity and word ordering. Large Language Models (LLMs) can also be used in this context, but they are not finance-specific and tend to require significant computational resources. To facilitate a finance specific LLM framework, we introduce a novel approach based on the Llama 2 7B foundational model, in order to benefit from its generative nature and comprehensive language manipulation. This is achieved by fine-tuning the Llama2 7B model on a small portion of supervised financial sentiment analysis data, so as to jointly handle the complexities of financial lexicon and context, and further equipping it with a neural network based decision mechanism. Such a generator-classifier scheme, referred to as FinLlama, is trained not only to classify the sentiment valence but also quantify its strength, thus offering traders a nuanced insight into financial news articles. Complementing this, the implementation of parameter-efficient fine-tuning through LoRA optimises trainable parameters, thus minimising computational and memory requirements, without sacrificing accuracy. Simulation results demonstrate the ability of the proposed FinLlama to provide a framework for enhanced portfolio management decisions and increased market returns. These results underpin the ability of FinLlama to construct high-return portfolios which exhibit enhanced resilience, even during volatile periods and unpredictable market events.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFinDPO: Financial Sentiment Analysis for Algorithmic Trading through Preference Optimization of LLMs

Wuyang Zhou, Giorgos Iacovides, Danilo Mandic

FinEntity: Entity-level Sentiment Classification for Financial Texts

Yi Yang, Yixuan Tang, Allen H Huang et al.

Open-FinLLMs: Open Multimodal Large Language Models for Financial Applications

Benyou Wang, Duanyu Feng, Yongfu Dai et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)