Summary

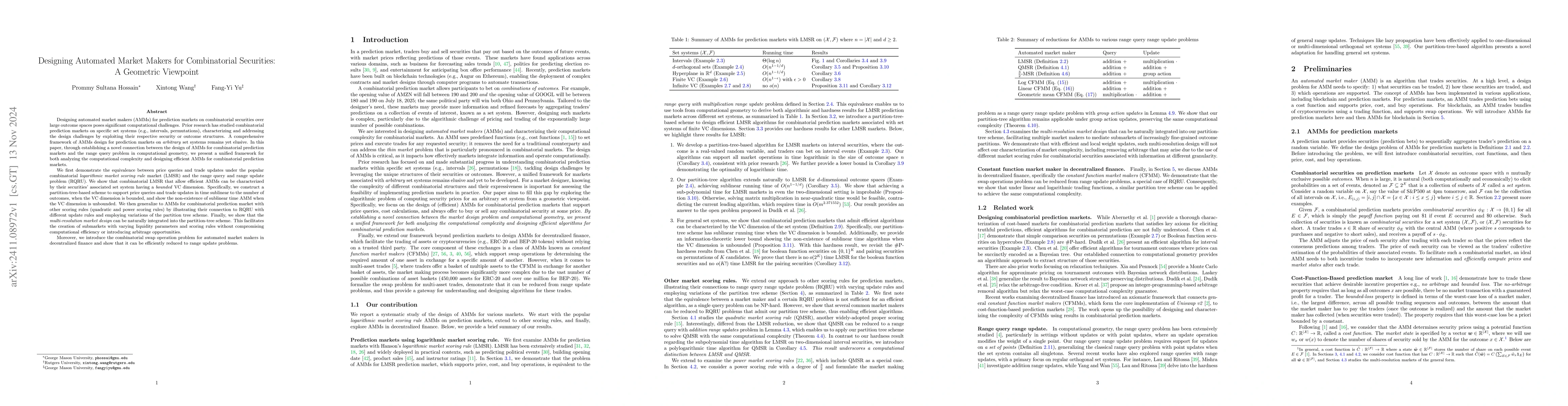

Designing automated market makers (AMMs) for prediction markets on combinatorial securities over large outcome spaces poses significant computational challenges. Prior research has primarily focused on combinatorial prediction markets within specific set systems (e.g., intervals, permutations). We introduce a framework for designing AMMs on arbitrary set systems by building a novel connection to the range query problem in computational geometry. This connection enables the analysis of computational complexity and the design of efficient AMMs. We first demonstrate the equivalence between price queries and trade updates under the popular combinatorial logarithmic market scoring rule market and the range query and range update problem. Building on this equivalence, we construct sublinear time algorithms when the VC dimension of the set system is bounded and show the non-existence of such algorithms for unbounded VC dimension cases. We then extend this approach to AMMs for combinatorial prediction markets with quadratic and power scoring rules. Finally, we show that the multi-resolution market design can be naturally integrated into the partition-tree scheme. Additionally, we introduce the combinatorial swap operation problem for automated market makers in decentralized finance and show that it can be efficiently reduced to range update problems.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersA General Framework for Impermanent Loss in Automated Market Makers

Alexander Port, Neelesh Tiruviluamala, Erik Lewis

No citations found for this paper.

Comments (0)