Authors

Summary

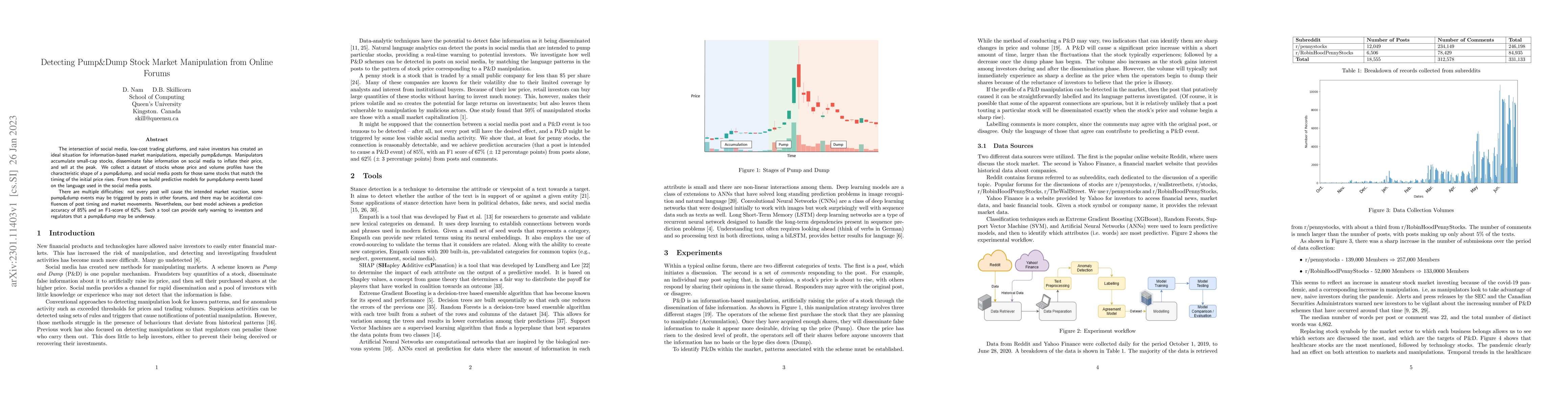

The intersection of social media, low-cost trading platforms, and naive investors has created an ideal situation for information-based market manipulations, especially pump&dumps. Manipulators accumulate small-cap stocks, disseminate false information on social media to inflate their price, and sell at the peak. We collect a dataset of stocks whose price and volume profiles have the characteristic shape of a pump&dump, and social media posts for those same stocks that match the timing of the initial price rises. From these we build predictive models for pump&dump events based on the language used in the social media posts. There are multiple difficulties: not every post will cause the intended market reaction, some pump&dump events may be triggered by posts in other forums, and there may be accidental confluences of post timing and market movements. Nevertheless, our best model achieves a prediction accuracy of 85% and an F1-score of 62%. Such a tool can provide early warning to investors and regulators that a pump&dump may be underway.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPump, Dump, and then What? The Long-Term Impact of Cryptocurrency Pump-and-Dump Schemes

Matthew Edwards, Joshua Clough

Crypto Pump and Dump Detection via Deep Learning Techniques

Viswanath Chadalapaka, Gireesh Mahajan, Kyle Chang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)