Authors

Summary

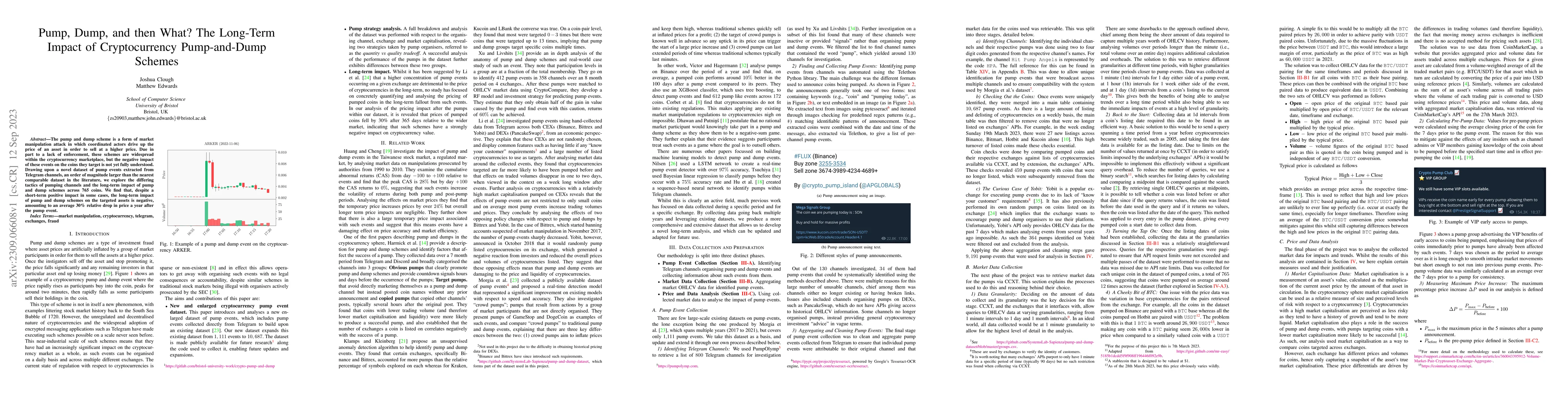

The pump and dump scheme is a form of market manipulation attack in which coordinated actors drive up the price of an asset in order to sell at a higher price. Due in part to a lack of enforcement, these schemes are widespread within the cryptocurrency marketplace, but the negative impact of these events on the coins they target is not yet fully understood. Drawing upon a novel dataset of pump events extracted from Telegram channels, an order of magnitude larger than the nearest comparable dataset in the literature, we explore the differing tactics of pumping channels and the long-term impact of pump and dump schemes across 765 coins. We find that, despite a short-term positive impact in some cases, the long-term impact of pump and dump schemes on the targeted assets is negative, amounting to an average 30% relative drop in price a year after the pump event.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers\textsc{Perseus}: Tracing the Masterminds Behind Cryptocurrency Pump-and-Dump Schemes

Jiahua Xu, Yebo Feng, Cong Wu et al.

The Anatomy of a Cryptocurrency Pump-and-Dump Scheme

Jiahua Xu, Benjamin Livshits

Sequence-Based Target Coin Prediction for Cryptocurrency Pump-and-Dump

Zhao Li, Sihao Hu, Zhen Zhang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)