Authors

Summary

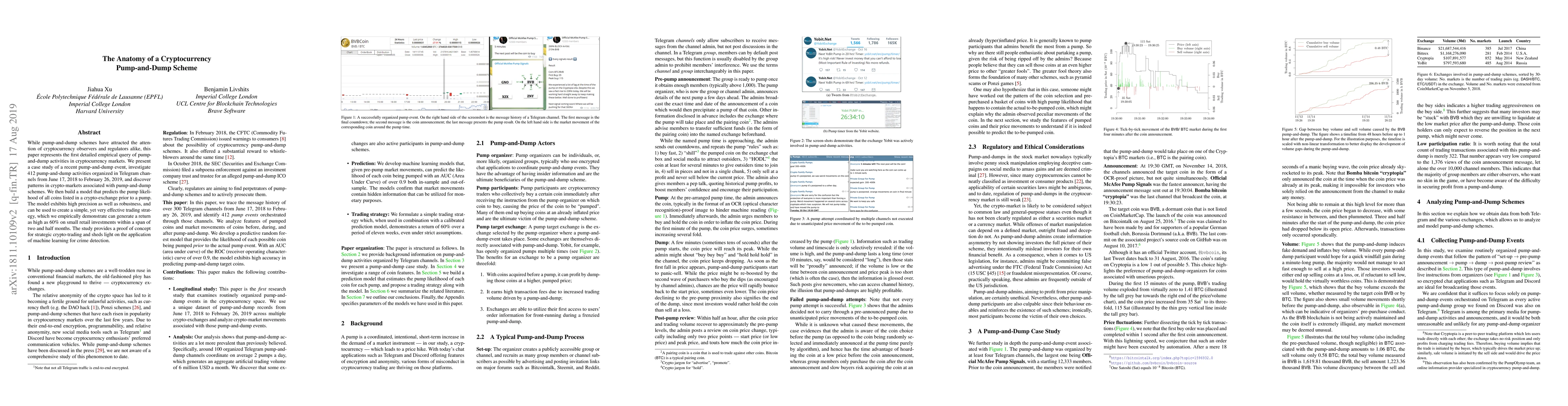

While pump-and-dump schemes have attracted the attention of cryptocurrency observers and regulators alike, this paper represents the first detailed empirical query of pump-and-dump activities in cryptocurrency markets. We present a case study of a recent pump-and-dump event, investigate 412 pump-and-dump activities organized in Telegram channels from June 17, 2018 to February 26, 2019, and discover patterns in crypto-markets associated with pump-and-dump schemes. We then build a model that predicts the pump likelihood of all coins listed in a crypto-exchange prior to a pump. The model exhibits high precision as well as robustness, and can be used to create a simple, yet very effective trading strategy, which we empirically demonstrate can generate a return as high as 60% on small retail investments within a span of two and half months. The study provides a proof of concept for strategic crypto-trading and sheds light on the application of machine learning for crime detection.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPump, Dump, and then What? The Long-Term Impact of Cryptocurrency Pump-and-Dump Schemes

Matthew Edwards, Joshua Clough

\textsc{Perseus}: Tracing the Masterminds Behind Cryptocurrency Pump-and-Dump Schemes

Jiahua Xu, Yebo Feng, Cong Wu et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)