Authors

Summary

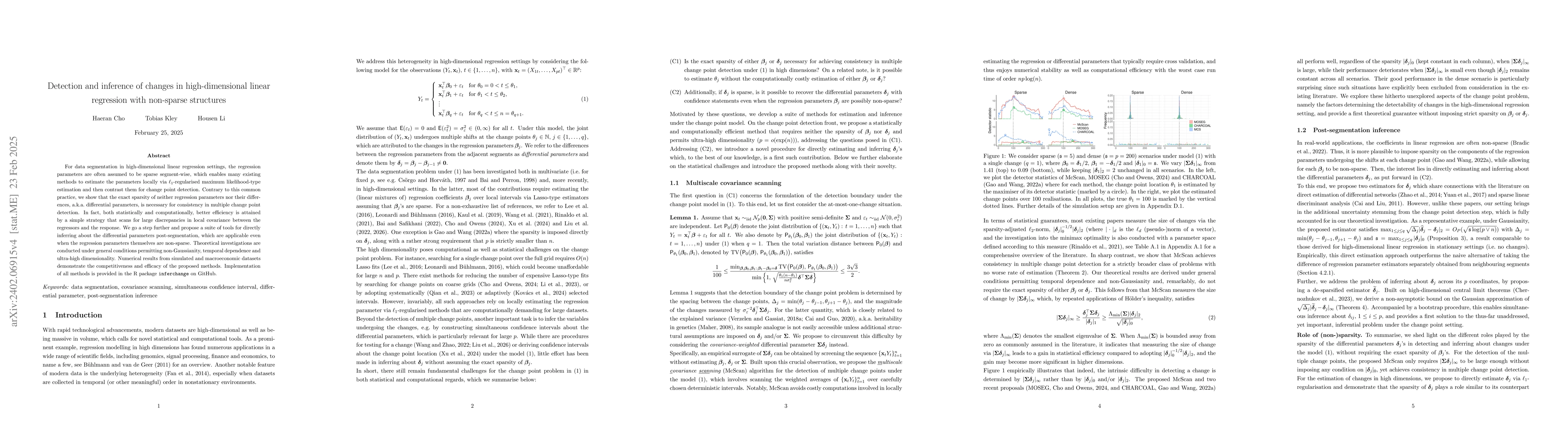

For data segmentation in high-dimensional linear regression settings, the regression parameters are often assumed to be sparse segment-wise, which enables many existing methods to estimate the parameters locally via $\ell_1$-regularised maximum likelihood-type estimation and then contrast them for change point detection. Contrary to this common practice, we show that the sparsity of neither regression parameters nor their differences, a.k.a. differential parameters, is necessary for consistency in multiple change point detection. In fact, both statistically and computationally, better efficiency is attained by a simple strategy that scans for large discrepancies in local covariance between the regressors and the response. We go a step further and propose a suite of tools for directly inferring about the differential parameters post-segmentation, which are applicable even when the regression parameters themselves are non-sparse. Theoretical investigations are conducted under general conditions permitting non-Gaussianity, temporal dependence and ultra-high dimensionality. Numerical results from simulated and macroeconomic datasets demonstrate the competitiveness and efficacy of the proposed methods.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSparse change detection in high-dimensional linear regression

Tengyao Wang, Fengnan Gao

Testability of high-dimensional linear models with non-sparse structures

Jelena Bradic, Jianqing Fan, Yinchu Zhu

Debiased Prediction Inference with Non-sparse Loadings in Misspecified High-dimensional Regression Models

Zhiqiang Tan, Libin Liang

Simultaneous Inference in Non-Sparse High-Dimensional Linear Models

Qi Zhang, Yanmei Shi, Zhiruo Li

| Title | Authors | Year | Actions |

|---|

Comments (0)