Authors

Summary

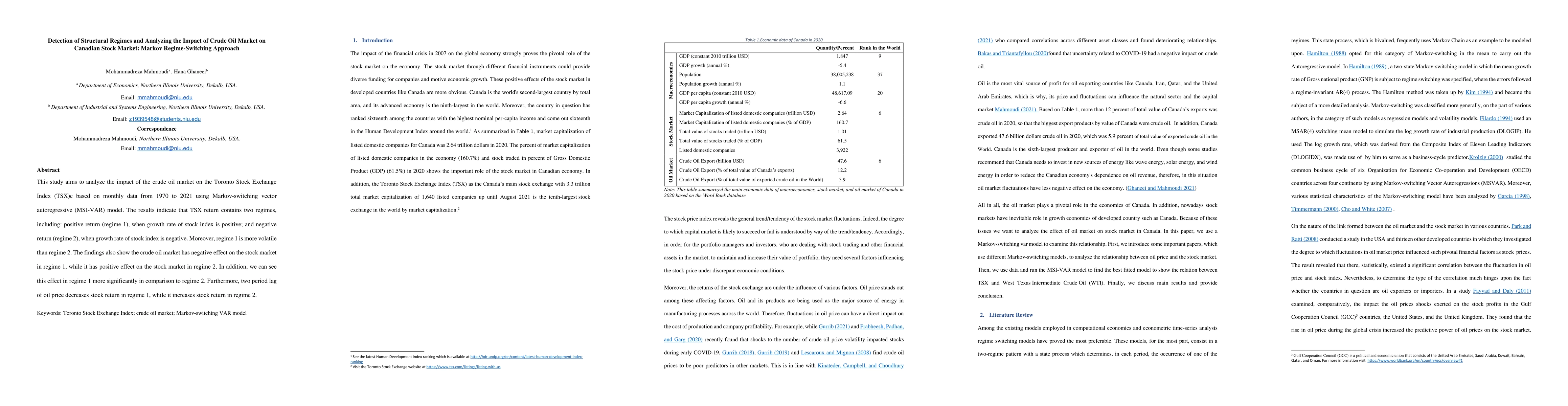

This study aims to analyze the impact of the crude oil market on the Toronto Stock Exchange Index (TSX)c based on monthly data from 1970 to 2021 using Markov-switching vector autoregressive (MSI-VAR) model. The results indicate that TSX return contains two regimes, including: positive return (regime 1), when growth rate of stock index is positive; and negative return (regime 2), when growth rate of stock index is negative. Moreover, regime 1 is more volatile than regime 2. The findings also show the crude oil market has negative effect on the stock market in regime 1, while it has positive effect on the stock market in regime 2. In addition, we can see this effect in regime 1 more significantly in comparison to regime 2. Furthermore, two period lag of oil price decreases stock return in regime 1, while it increases stock return in regime 2.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)