Authors

Summary

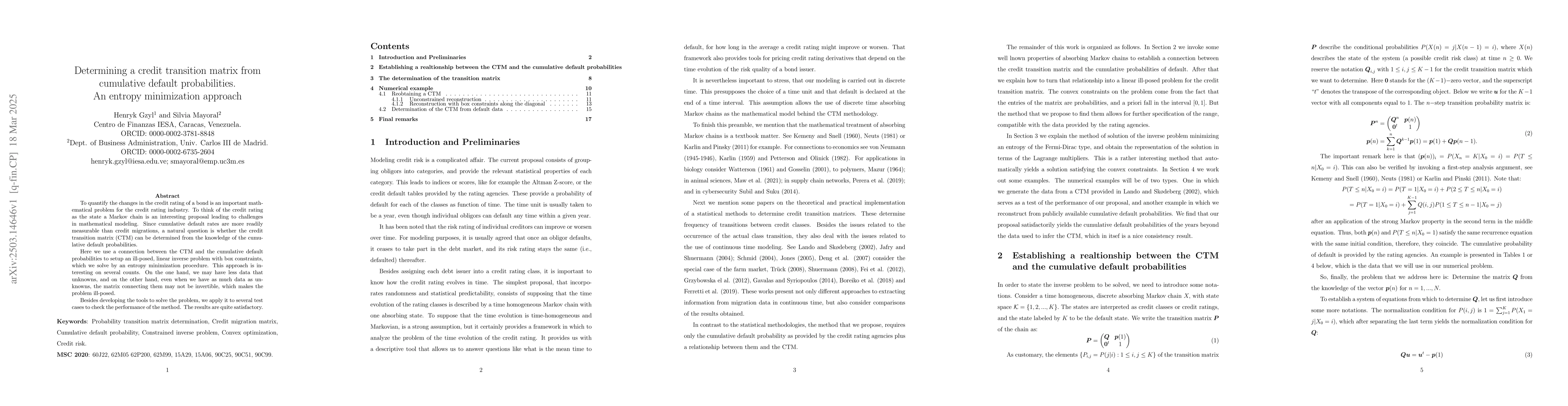

To quantify the changes in the credit rating of a bond is an important mathematical problem for the credit rating industry. To think of the credit rating as the state a Markov chain is an interesting proposal leading to challenges in mathematical modeling. Since cumulative default rates are more readily measurable than credit migrations, a natural question is whether the credit transition matrix (CTM) can be determined from the knowledge of the cumulative default probabilities. Here we use a connection between the CTM and the cumulative default probabilities to setup an ill-posed, linear inverse problem with box constraints, which we solve by an entropy minimization procedure. This approach is interesting on several counts. On the one hand, we may have less data that unknowns, and on the other hand, even when we have as much data as unknowns, the matrix connecting them may not be invertible, which makes the problem ill-posed. Besides developing the tools to solve the problem, we apply it to several test cases to check the performance of the method. The results are quite satisfactory.

AI Key Findings

Generated Jun 10, 2025

Methodology

The research proposes a method to determine a credit transition matrix (CTM) from cumulative default probabilities using an entropy minimization procedure for an ill-posed linear inverse problem with box constraints.

Key Results

- The method successfully reconstructs CTMs from cumulative default probabilities with satisfactory results in test cases.

- The approach handles cases where there might be less data than unknowns or as much data as unknowns, even when the connecting matrix is not invertible.

Significance

This research is important for the credit rating industry as it provides a way to quantify changes in bond credit ratings using readily measurable cumulative default probabilities, addressing challenges in mathematical modeling.

Technical Contribution

The paper develops an entropy minimization procedure to solve an ill-posed, linear inverse problem for determining CTMs from cumulative default probabilities, providing a novel approach to address challenges in credit rating modeling.

Novelty

The novelty of this work lies in its approach to handling the ill-posed linear inverse problem with box constraints through entropy minimization, offering a solution where traditional methods might struggle with limited or abundant data compared to unknowns.

Limitations

- The method assumes discretetime framework, which might not be directly applicable in a continuous-time modeling context.

- The ill-posed nature of the problem implies that there could be multiple solutions, and the determinant of the matrix A is close to zero, suggesting infinitely many solutions.

Future Work

- Investigate potential adaptations for continuous-time modeling using alternative measurable data related to absorption (default) times.

- Explore the possibility of extending the method to handle more complex credit risk models.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)