Summary

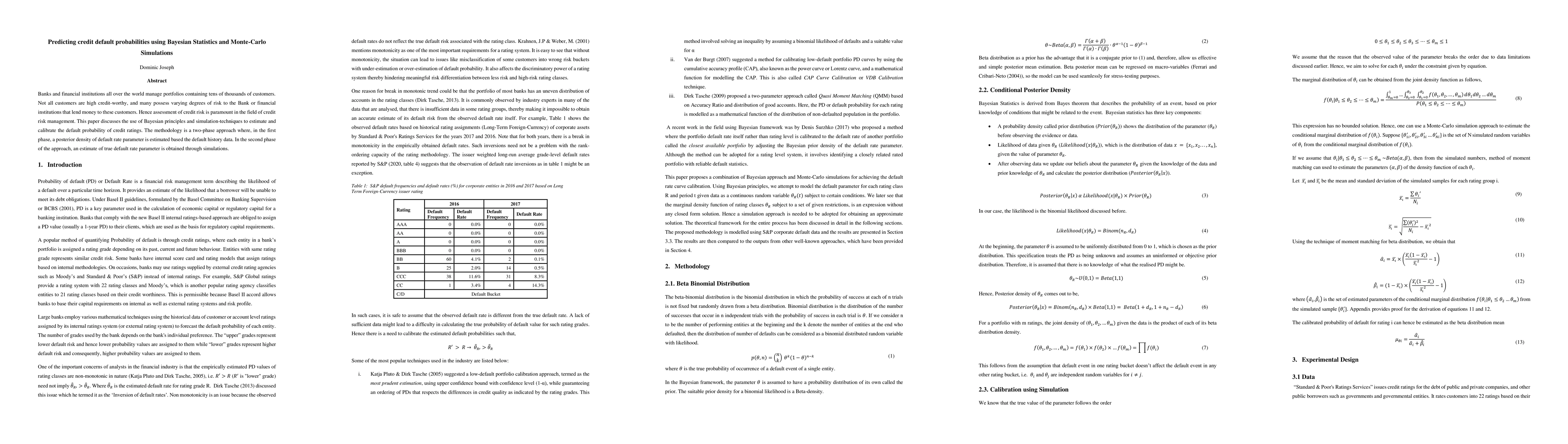

Banks and financial institutions all over the world manage portfolios containing tens of thousands of customers. Not all customers are high credit-worthy, and many possess varying degrees of risk to the Bank or financial institutions that lend money to these customers. Hence assessment of credit risk is paramount in the field of credit risk management. This paper discusses the use of Bayesian principles and simulation-techniques to estimate and calibrate the default probability of credit ratings. The methodology is a two-phase approach where, in the first phase, a posterior density of default rate parameter is estimated based the default history data. In the second phase of the approach, an estimate of true default rate parameter is obtained through simulations

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)