Summary

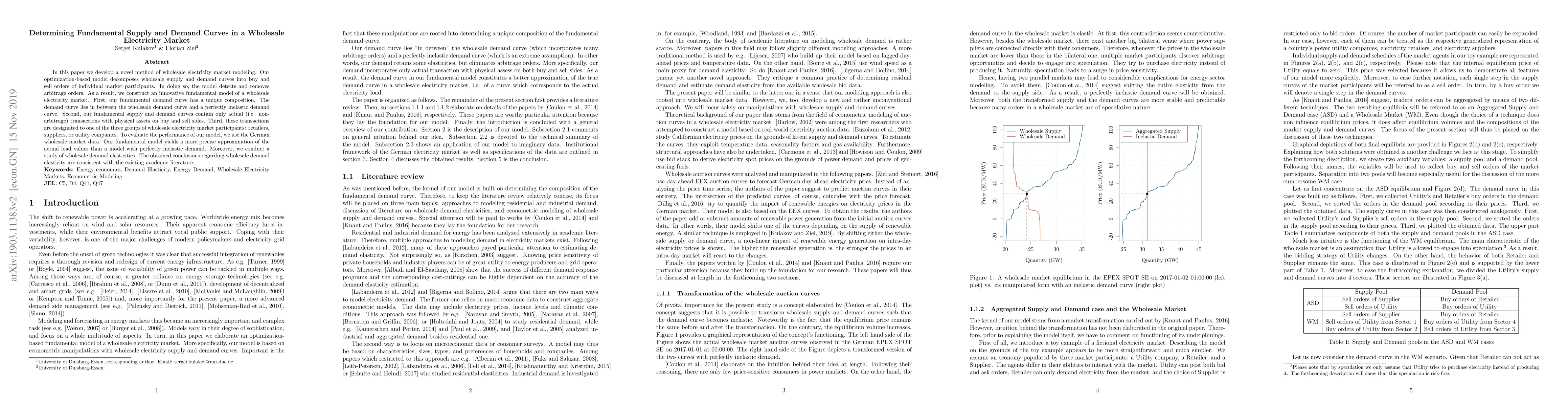

In this paper we develop a novel method of wholesale electricity market modeling. Our optimization-based model decomposes wholesale supply and demand curves into buy and sell orders of individual market participants. In doing so, the model detects and removes arbitrage orders. As a result, we construct an innovative fundamental model of a wholesale electricity market. First, our fundamental demand curve has a unique composition. The demand curve lies in between the wholesale demand curve and a perfectly inelastic demand curve. Second, our fundamental supply and demand curves contain only actual (i.e. non-arbitrage) transactions with physical assets on buy and sell sides. Third, these transactions are designated to one of the three groups of wholesale electricity market participants: retailers, suppliers, or utility companies. To evaluate the performance of our model, we use the German wholesale market data. Our fundamental model yields a more precise approximation of the actual load values than a model with perfectly inelastic demand. Moreover, we conduct a study of wholesale demand elasticities. The obtained conclusions regarding wholesale demand elasticity are consistent with the existing academic literature.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)