Summary

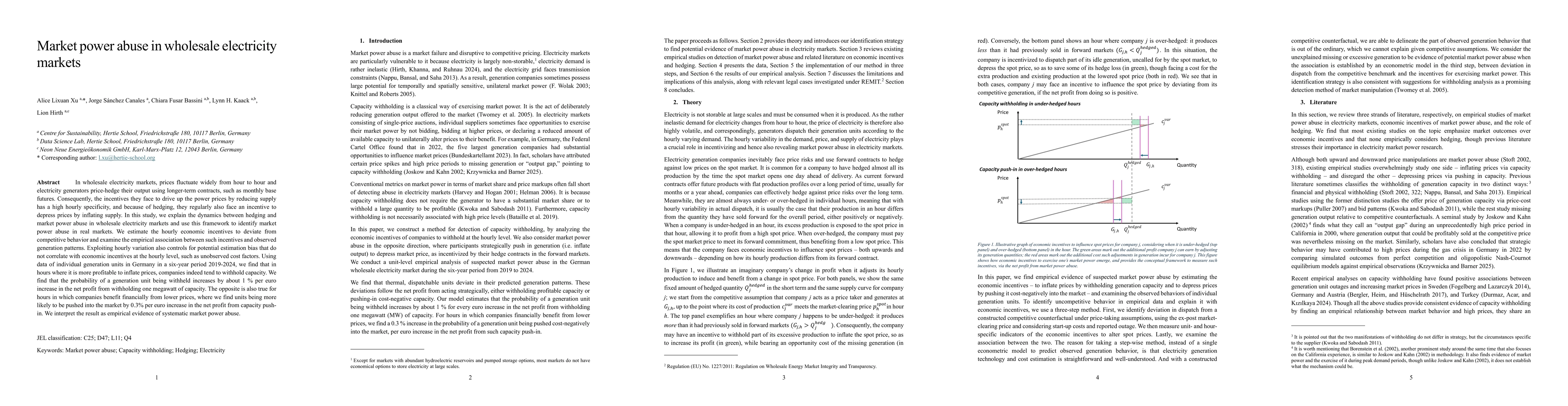

In wholesale electricity markets, prices fluctuate widely from hour to hour and electricity generators price-hedge their output using longer-term contracts, such as monthly base futures. Consequently, the incentives they face to drive up the power prices by reducing supply has a high hourly specificity, and because of hedging, they regularly also face an incentive to depress prices by inflating supply. In this study, we explain the dynamics between hedging and market power abuse in wholesale electricity markets and use this framework to identify market power abuse in real markets. We estimate the hourly economic incentives to deviate from competitive behavior and examine the empirical association between such incentives and observed generation patterns. Exploiting hourly variation also controls for potential estimation bias that do not correlate with economic incentives at the hourly level, such as unobserved cost factors. Using data of individual generation units in Germany in a six-year period 2019-2024, we find that in hours where it is more profitable to inflate prices, companies indeed tend to withhold capacity. We find that the probability of a generation unit being withheld increases by about 1 % per euro increase in the net profit from withholding one megawatt of capacity. The opposite is also true for hours in which companies benefit financially from lower prices, where we find units being more likely to be pushed into the market by 0.3 % per euro increase in the net profit from capacity push-in. We interpret the result as empirical evidence of systematic market power abuse.

AI Key Findings

Generated Jun 08, 2025

Methodology

The study uses hourly data of individual generation units in Germany over a six-year period (2019-2024) to estimate hourly economic incentives for deviating from competitive behavior in wholesale electricity markets. It examines the association between these incentives and actual generation patterns, exploiting hourly variation to control for potential estimation bias.

Key Results

- Companies tend to withhold capacity when it's more profitable to inflate prices, with a 1% increase in the probability of withholding per euro increase in net profit from withholding one MW of capacity.

- In hours where companies benefit financially from lower prices, generation units are more likely to be pushed into the market, increasing by 0.3% per euro increase in net profit from capacity push-in.

- Findings suggest systematic market power abuse in wholesale electricity markets.

Significance

This research is important as it provides empirical evidence of market power abuse in wholesale electricity markets, which can inform regulatory policies and market designs to prevent such abuses and ensure fair competition.

Technical Contribution

The paper introduces a framework to explain the dynamics between hedging and market power abuse in wholesale electricity markets, estimating hourly economic incentives for non-competitive behavior.

Novelty

This work stands out by combining hourly market data with an analysis of hedging strategies to identify market power abuse, providing a more nuanced understanding of generator behavior in electricity markets.

Limitations

- The study is limited to the German market and may not be generalizable to other markets without further investigation.

- It does not account for external factors like regulatory changes or technological advancements that could influence market dynamics.

Future Work

- Further research could explore similar patterns in other electricity markets to validate these findings on a broader scale.

- Investigating the impact of regulatory changes and technological advancements on market power abuse dynamics would be valuable.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCorrelations and Clustering in Wholesale Electricity Markets

Francesco Caravelli, Tianyu Cui, Cozmin Ududec

No citations found for this paper.

Comments (0)