Summary

Stop-loss rules are often studied in the financial literature, but the stop-loss levels are seldom constructed systematically. In many papers, and indeed in practice as well, the level of the stops is too often set arbitrarily. Guided by the overarching goal in finance to maximize expected returns given available information, we propose a natural method by which to systematically select the stop-loss threshold by analyzing the distribution of maximum drawdowns. We present results for an hourly trading strategy with two variations on the construction.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

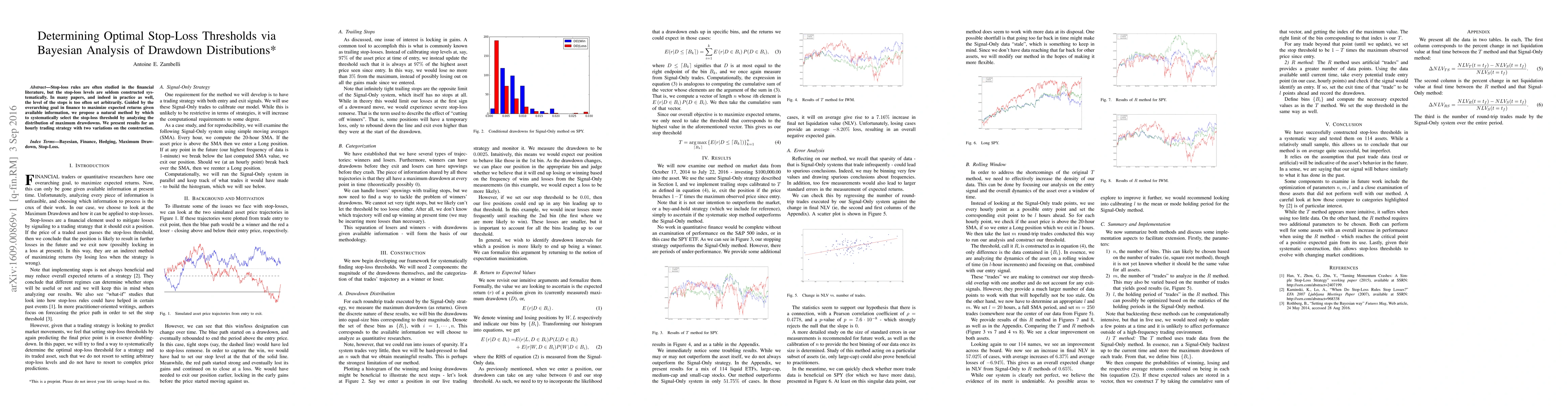

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Bayesian Mixture Modelling of Stop Signal Reaction Time Distributions

Mohsen Soltanifar, Michael Escobar, Annie Dupuis et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)