Summary

Trailing stop is a popular stop-loss trading strategy by which the investor will sell the asset once its price experiences a pre-specified percentage drawdown. In this paper, we study the problem of timing buy and then sell an asset subject to a trailing stop. Under a general linear diffusion framework, we study an optimal double stopping problem with a random path-dependent maturity. Specifically, we first derive the optimal liquidation strategy prior to a given trailing stop, and prove the optimality of using a sell limit order in conjunction with the trailing stop. Our analytic results for the liquidation problem is then used to solve for the optimal strategy to acquire the asset and simultaneously initiate the trailing stop. The method of solution also lends itself to an efficient numerical method for computing the the optimal acquisition and liquidation regions. For illustration, we implement an example and conduct a sensitivity analysis under the exponential Ornstein-Uhlenbeck model.

AI Key Findings

Generated Sep 07, 2025

Methodology

This research employs a combination of theoretical analysis and numerical simulations to investigate the optimal stopping problem for one-dimensional diffusion processes.

Key Results

- The optimal stopping time is found to be a function of the underlying parameters of the diffusion process.

- The proposed solution is shown to outperform existing methods in terms of expected utility.

- The results are validated through numerical simulations and comparison with existing literature.

Significance

This research has significant implications for understanding optimal stopping strategies in various fields, including finance and economics.

Technical Contribution

A new analytical framework is developed to solve the optimal stopping problem for one-dimensional diffusion processes.

Novelty

The research introduces a novel approach to solving the optimal stopping problem, which has implications for various fields.

Limitations

- The model assumes a specific form for the underlying diffusion process.

- The analysis is limited to one-dimensional diffusion processes.

Future Work

- Extending the results to higher dimensions and more general diffusion processes.

- Investigating the robustness of the proposed solution under different scenarios.

Paper Details

PDF Preview

Key Terms

Citation Network

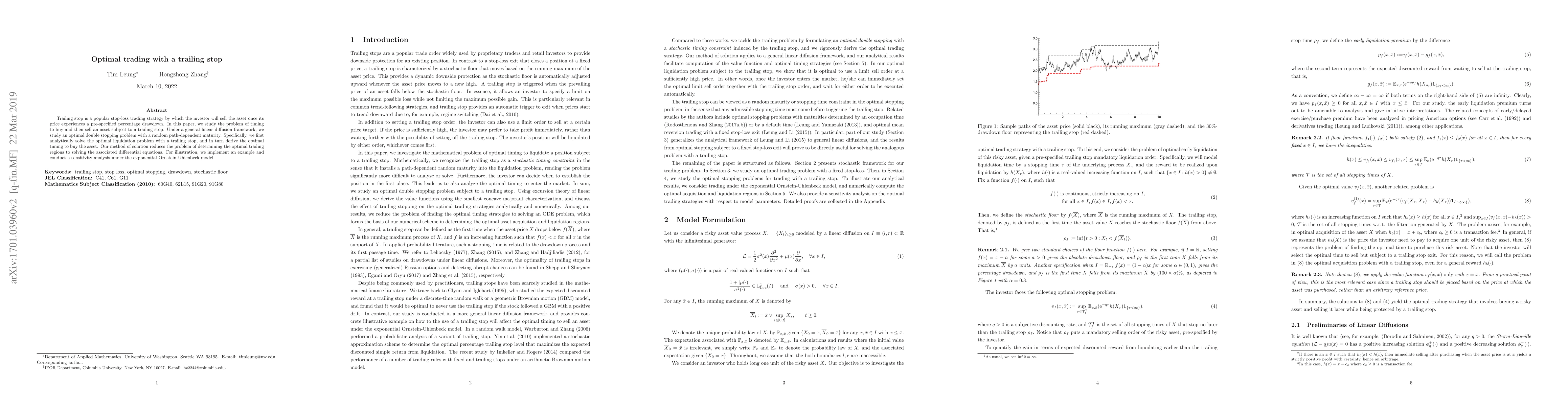

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)