Summary

We derive deterministic criteria for the existence and non-existence of equivalent (local) martingale measures for financial markets driven by multi-dimensional time-inhomogeneous diffusions. Our conditions can be used to construct financial markets in which the \emph{no unbounded profit with bounded risk} condition holds, while the classical \emph{no free lunch with vanishing risk} condition fails.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

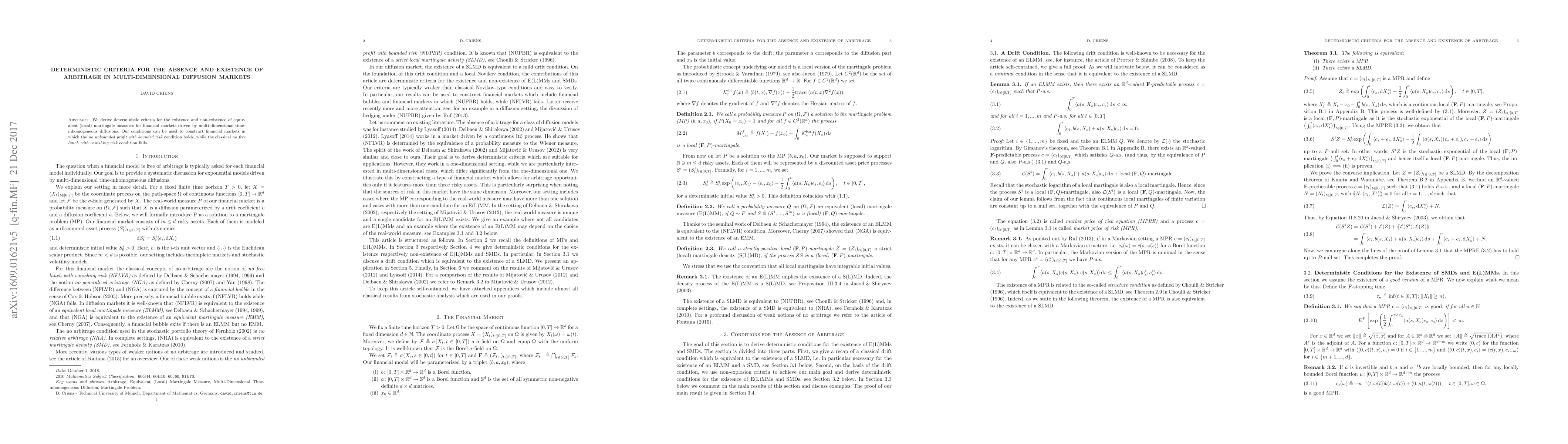

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)