Summary

We obtain a deterministic characterisation of the \emph{no free lunch with vanishing risk}, the \emph{no generalised arbitrage} and the \emph{no relative arbitrage} conditions in the one-dimensional diffusion setting and examine how these notions of no-arbitrage relate to each other.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

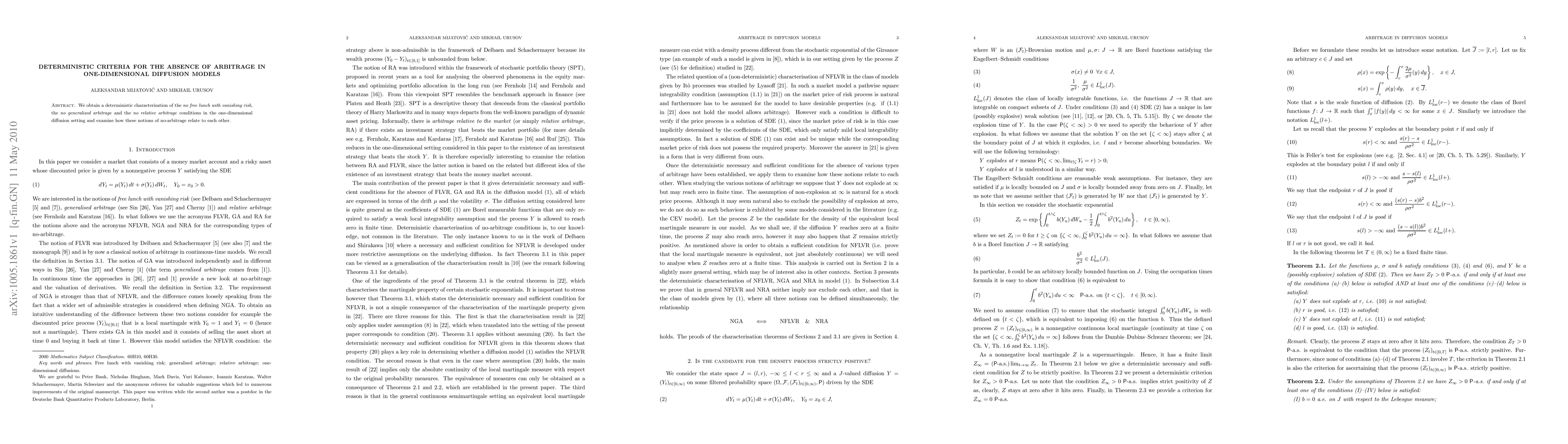

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)