Summary

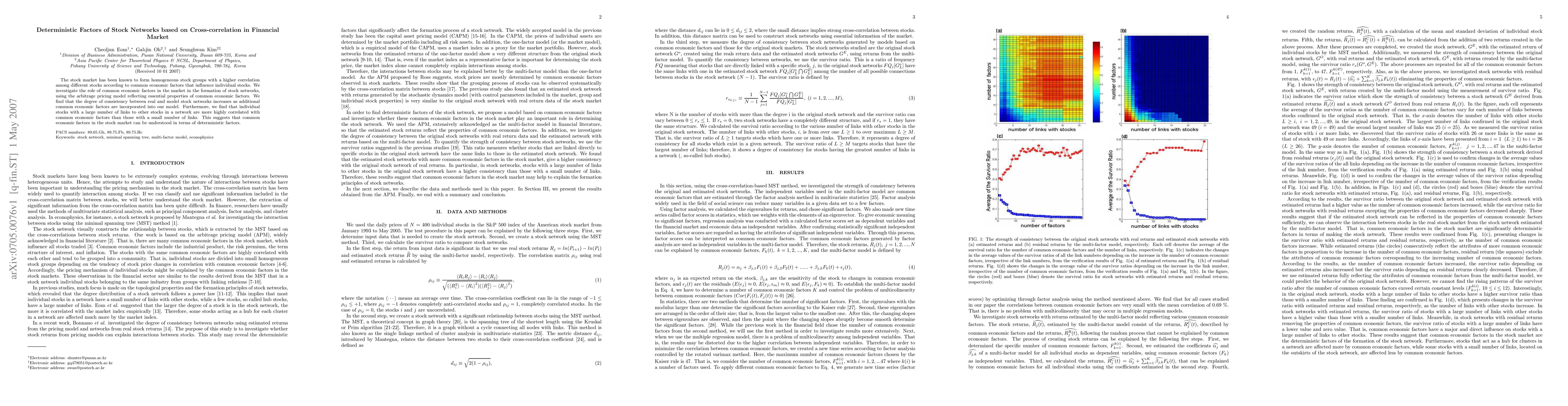

The stock market has been known to form homogeneous stock groups with a higher correlation among different stocks according to common economic factors that influence individual stocks. We investigate the role of common economic factors in the market in the formation of stock networks, using the arbitrage pricing model reflecting essential properties of common economic factors. We find that the degree of consistency between real and model stock networks increases as additional common economic factors are incorporated into our model. Furthermore, we find that individual stocks with a large number of links to other stocks in a network are more highly correlated with common economic factors than those with a small number of links. This suggests that common economic factors in the stock market can be understood in terms of deterministic factors.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCross-Lingual News Event Correlation for Stock Market Trend Prediction

Seemab Latif, Rabia Latif, Sahar Arshad et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)